Image Source: Mint

Image Source: Mint

Key highlights

India’s fashion industry is undergoing a dramatic transformation as conglomerates like Reliance Industries and Aditya Birla Group move to dominate every corner of the market—reimagining retail, setting growth records, and changing the way Indians shop and style themselves.

The Reliance Playbook: National Scale, Local Roots

Reliance Industries is also opening low-cost Trends stores at a breakneck pace, with a target of 2,500 outlets in 300 cities within five years, from a mere 557 currently. This aggressive push is riding on India's huge young population and increasing smartphone penetration, bringing affordable and fashionable private labels to non-metro centers.

Reliance Fashion World's tie-up with Francorp launches fashion franchising in new rural and urban hubs, empowering small retailers and linking them to a supply chain of more than three lakh styles through Ajio Business.

Such strategic partnerships, as with Shein, mark the beginning of a new export-driven phase: Reliance wants 1,000 Indian factories to make fast fashion for the world, positioning India as a manufacturing hub for both local and global consumers.

The firm's "new commerce" approach combines e-commerce, logistics, and inventory management—providing Reliance with a competitive advantage in supply chain efficiency and product margins.

Aditya Birla's Brand Barn: From Legacy to Luxury

Aditya Birla Group had recently demerged its fashion business, listing Aditya Birla Lifestyle Brands Limited (ABLBL) on the bourses for greater strategic focus.

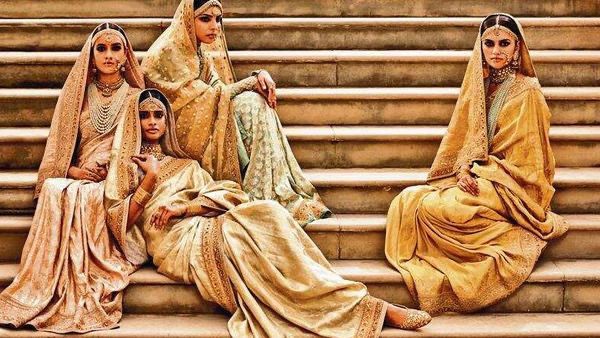

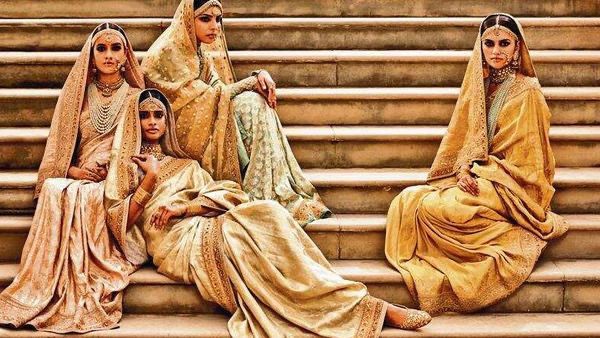

ABLBL now hosts core brands like Louis Philippe, Van Heusen, Allen Solly, and Peter England, and is placing large bets on newer entrants such as Reebok and American Eagle. The group anticipates doubling revenue and tripling profits from its lifestyle roster in the next five years. The holding company maintains niche portfolios—from mass market favourite Pantaloons and designer labels such as Sabyasachi, Shantanu & Nikhil, and House of Masaba to luxury importers such as The Collective and Ralph Lauren.

Collectively, the Aditya Birla retail chain covers over 11.9 million sq. ft., with over 4,400 stores across the country and a burgeoning digital-first fashion business, TMRW.

Industry Impact and What's Next

Both behemoths are driving industry growth, with India's clothing market poised to exceed $120 billion in 2025 and projected double-digit growth until 2030.

Their investments fuel innovation, establish price points, and reshape consumer expectations—erasing the distinction between boutique curation and big-league scale.

As mid-size brands ally or collide, and with new supply chains connecting India's boutiques to global fast fashion, the scene is set for increasingly daring style, scale, and disruption in Indian fashion.

Sources: Textile Excellence, The Week, Reuters

Advertisement

Advertisement