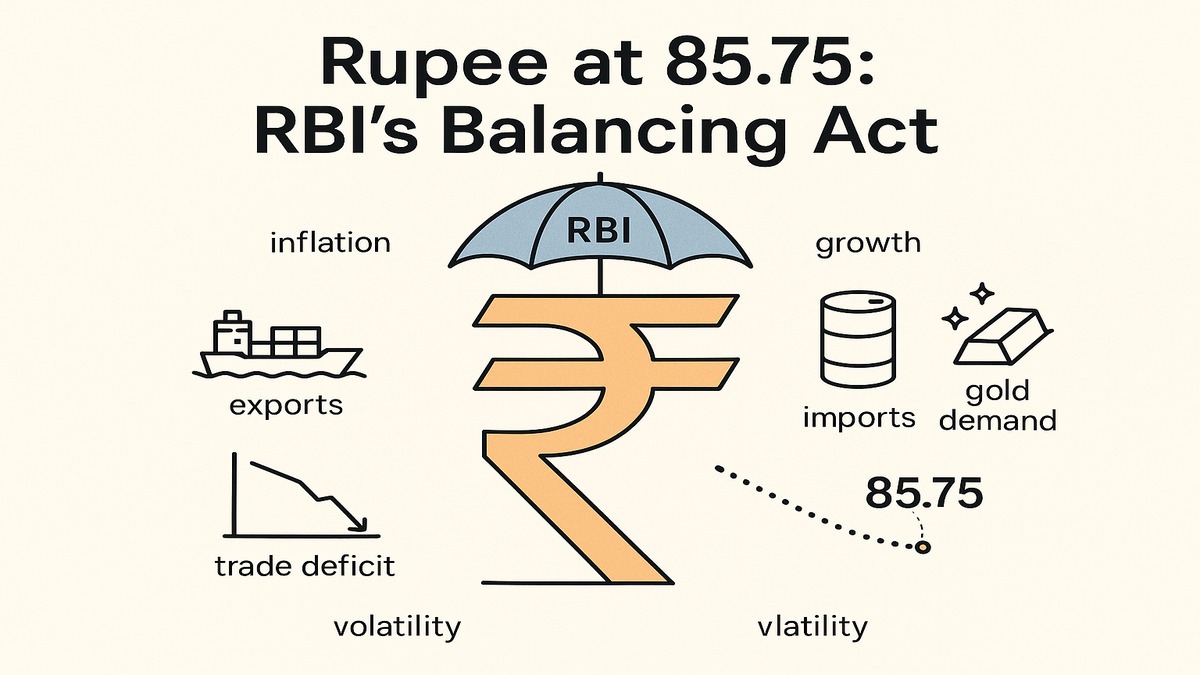

India's money markets began on Tuesday with a small gain to the rupee, which rose 0.1% to 85.75 against the US dollar, from the previous close of 85.85. The action comes after a string of liquidity operations by the Reserve Bank of India (RBI) and defensive sentiment in advance of global tariff deadlines.

Major Currency Movement:

-

The rupee opened at 85.75/USD, ending a nineday streak and exhibiting mild strength in spite of mounting external pressures on the dollar.

-

Oil importers' demand for dollars at monthend and corporate hedging had been previously bearing down on the currency.

RBI's Liquidity Snapshot as of July 7, 2025:

-

RBI balances with banks were ₹9.31 trillion, indicating good liquidity in the system.

-

The central bank carried out ₹59.87 billion of refinance business, allowing shortterm finance needs.

-

No government surplus funds were available for sale, which implied tight fiscal positioning or coordinated spending planning.

-

Banks borrowed ₹10.51 billion from the Marginal Standing Facility (MSF), a marginal rise which shows overnight liquidity needs in the absence of system pressure.

Market Implications:

-

The rupee is under pressure due to global trade uncertainties, particularly after the July 9 US tariff announcement.

-

The currency is likely to remain in the 85.5086.00 band in the near term with RBI intervention likely in case volatility picks up.

Investor Sentiment:

-

US economic data and oil price action are what traders are seeking guidance from.

-

RBI calibrated liquidity support suggests a stability bias as opposed to aggressive easing.

Sources: Reuters, Economic Times, Investment Guru India, Wall Street Journal