Image Source: Facebook

Image Source: Facebook

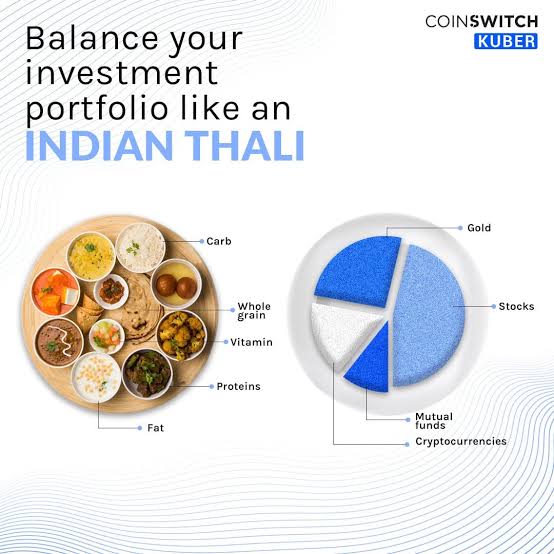

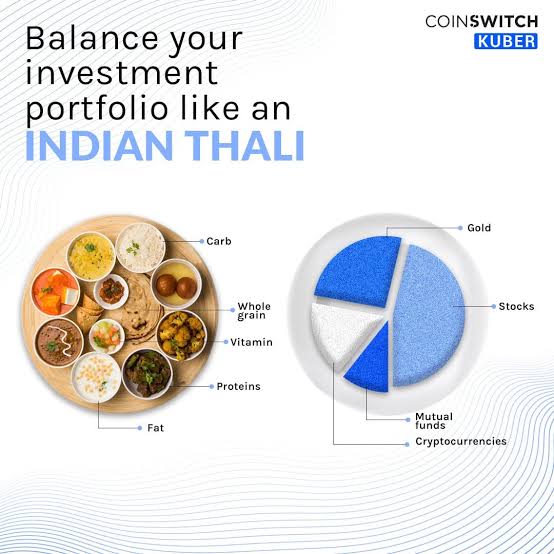

In the world of investing, the Great Indian Thali offers a deliciously apt analogy for building a robust, diversified portfolio. Just as a thali brings together a variety of flavors, textures, and nutrients on a single plate, a well-curated investment portfolio blends different asset classes to create a balanced, resilient financial meal.

Key Highlights

The thali’s diversity—rice, dal, vegetables, roti, pickles, and dessert—mirrors the need for a mix of equities, debt, gold, real estate, and cash in your portfolio. Each component serves a unique purpose: equities drive growth, debt provides stability, gold acts as a hedge, and cash ensures liquidity.

Recent financial advice in India emphasizes the importance of multi-asset allocation, especially in volatile markets. Multi-asset funds, which combine equity, debt, and commodities, have outperformed single-asset strategies over the past three to five years, delivering better risk-adjusted returns.

International diversification is gaining traction. Studies show that portfolios with global exposure are more resilient over the long term, reducing the impact of local market downturns and currency fluctuations.

The Reserve Bank of India and leading financial experts recommend periodic portfolio rebalancing, much like adjusting the proportions of a thali to suit changing tastes and nutritional needs. This ensures your investments remain aligned with your goals and risk appetite.

The latest consumer surveys reveal a growing optimism among Indian investors, with a majority expressing confidence in achieving their financial goals through disciplined, diversified investing.

A well-balanced portfolio, like a thali, is not about excess but about thoughtful inclusion—ensuring every element contributes to your financial well-being.

Sources: Times of India, News18, Economic Times, The Wire, S&P Global, Financial Express

Advertisement

Advertisement