Banaras Beads Ltd reported a decline in turnover and profit for the quarter ended 30 September 2025, citing export headwinds and ongoing US tariff challenges. Despite the short-term pressure, the company remains optimistic that its full-year turnover will match or exceed last year’s performance.

Quarterly Performance Overview

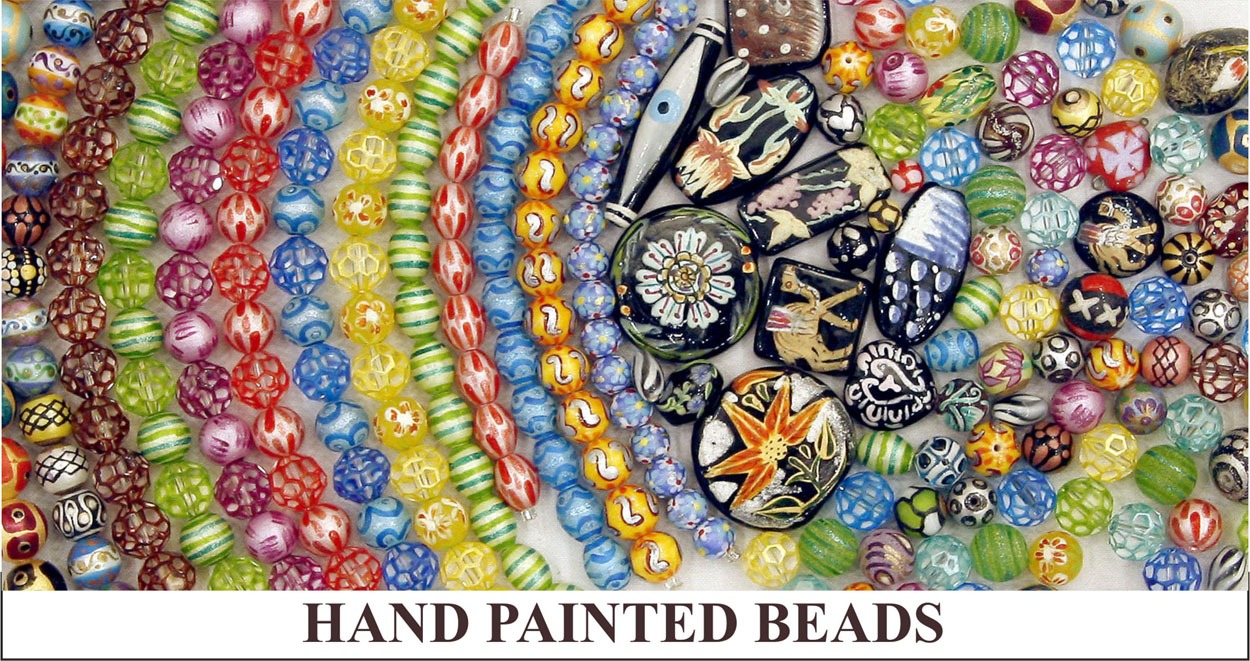

Banaras Beads Ltd, a prominent exporter of fashion accessories and handicrafts, has posted weaker financial results for Q2 FY26. The company attributed the dip in earnings to subdued export demand and tariff-related pressures in the US market. However, management remains confident about a recovery in the coming quarters, supported by ongoing negotiations with US buyers and diversification into new markets.

Major Takeaways

-

Turnover and profit declined in Q2 FY26 due to export and tariff challenges

-

The company is actively negotiating with US buyers to address duty-related pricing concerns

-

Domestic demand remained stable, helping offset some export-related losses

-

Operational costs were managed efficiently, though forex volatility added pressure

-

Banaras Beads expects full-year turnover to match or exceed FY25 levels

Notable Updates

-

The company is exploring new export markets in Europe and Southeast Asia to reduce dependency on the US

-

Product innovation and artisan-led design upgrades are being prioritized to enhance global competitiveness

-

Management is committed to sustaining employment and local sourcing despite global trade uncertainties

Sources: Economic Times, Livemint, Moneycontrol, Banaras Beads investor disclosures