Image Source: Hindustan Times

Image Source: Hindustan Times

An extraordinary banking incident in Greater Noida has captured nationwide attention after an 18-year-old student and his late mother's bank account reflected astronomically large sums—figures so colossal they defy comprehension, running into hundreds of trillions of rupees. Widely shared on social media, the baffling balances sparked debates about the possibility of India's largest-ever banking glitch and raised questions on the security and reliability of digital banking platforms.

Key Highlights: The Bizarre Case of Rs 1.13 Lakh Crore and Beyond

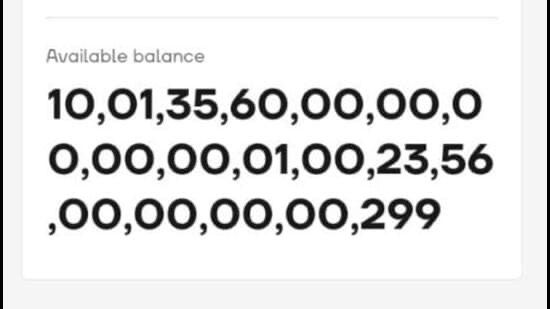

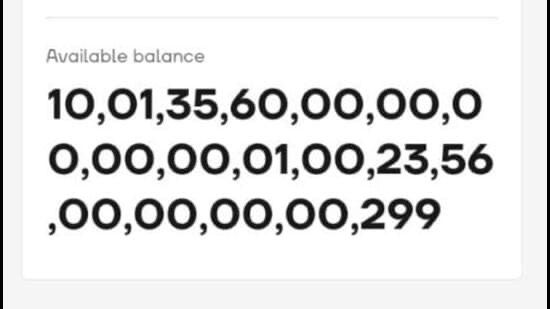

Dalip Singh, a 12th-grade student from Unchi Dankaur in Greater Noida, encountered a surreal balance of approximately Rs 1.13 lakh crore displayed in his savings account on the Navi mobile banking app on August 4, 2025. Singh immediately reported the anomaly to local police.

Simultaneously, Deepak Kumar, another young Greater Noida resident, discovered an even more staggering figure—reportedly exceeding Rs 1 septillion trillion—in his deceased mother's Kotak Mahindra Bank account accessed via a UPI-linked app. This unexpected sum rendered the account frozen and prompted an Income Tax Department probe.

Both accounts were found to be frozen or inactive; investigation revealed that these figures were not actual deposits but resulted from technical glitches in the respective mobile banking and UPI applications.

Investigation and Official Responses

Law enforcement agencies and bank officials collaborated swiftly, confirming that no real transactions of such enormous amounts had taken place. The balances appeared only within certain digital banking interfaces, not reflected in official bank records.

The police confirmed that Dalip Singh's account actually held a zero or negative balance and had been frozen due to inactivity or irregularities.

Kotak Mahindra Bank issued explicit denials of any glitch or unauthorized credits in its systems. The bank emphasized that its core systems were secure and operating normally, urging customers to verify balances directly through the official banking apps rather than third-party platforms.

The Income Tax Department initiated an inquiry to eliminate any concerns over potential money laundering or fraudulent activity linked to the reported amounts.

Technical Insights: Glitch or Bug?

Experts suggest that the incident likely originated from a software bug or data processing error within third-party banking applications that incorrectly rendered account balances.

Such glitches may occur due to corrupted data, synchronization failures, or security lapses between banking servers and integrated mobile platforms.

The peculiar formatting of the displayed amounts—featuring a 36 to 37-digit figure—indicates a probable numerical overflow or placeholder error rather than legitimate account history.

Bankers and cybersecurity specialists highlight the importance of stringent app validations and frequent audits to prevent misinformation and maintain customer trust.

Social Media Frenzy and Public Reaction

Screenshots of the astronomical balances went viral on platforms like Twitter, Instagram, and WhatsApp, triggering widespread astonishment, memes, and speculative discussions.

Some netizens humorously pondered what they would do if suddenly credited with such wealth, while others raised concerns about banking system robustness.

The incident underlined the need for clear communication from financial institutions to curb misinformation and panic.

Implications and Lessons for India’s Digital Banking Ecosystem

Although no actual loss or unauthorized transfers occurred, the incident reveals vulnerabilities in third-party financial application ecosystems that aggregate bank data.

With India's banking sector rapidly digitizing and an increasing reliance on mobile apps and UPI for transactions, user confidence hinges on accurate real-time data display.

The episode serves as a wake-up call for banks and fintech providers to enhance integration security, rigorous testing before releases, and transparent customer grievance redressal mechanisms.

Regulators and banks are encouraged to mandate user education emphasizing official app usage and caution against undue reliance on unverified platforms.

Context: Has India Experienced a Bigger Glitch Before?

While episodic banking software glitches and transactional errors are not uncommon globally, no prior publicly reported incident has involved figures of this mind-boggling magnitude in India.

This episode arguably sets a record for scale of displayed error, though lacking impact on actual funds, placing it among the largest digital anomalies in the nation’s financial history.

Conclusion

The massive, erroneous crediting of astronomical amounts into accounts in Greater Noida reflects not a banking catastrophe but a quintessential technical glitch amidst India's fast-evolving digital finance landscape. As investigations affirm system integrity and dismiss fraudulent transactions, the event underlines the critical importance of technological robustness and customer awareness in fostering trustworthy digital banking experiences. While not India's "biggest banking glitch" in terms of finance lost, the spectacle of trillion-rupee errors commands lessons for safeguarding the digital future of finance.

Sources: Hindustan Times, PTC News, Times of India

Advertisement

Advertisement