Image Source: Genesis Group

Image Source: Genesis Group

For generations, owning a home in India has symbolized stability, success, and social standing. From family dinner table conversations to long-term financial planning, real estate has often been the centerpiece of wealth creation. But in 2025, as interest rates rise and urban property markets stagnate, a growing number of financial experts are urging Indians to rethink the true cost of home ownership—especially when it comes to personal net worth.

A recent analysis by Moneycontrol reveals that for middle-class Indians, the emotional satisfaction of owning property may be coming at the expense of long-term financial growth. Let’s unpack the numbers, the psychology, and the alternatives.

Key Financial Realities Behind Home Ownership

- Real estate returns in India have historically hovered around 8 to 9 percent CAGR, often inflated by long holding periods rather than actual annual growth

- Home loans with interest rates between 7.5 to 8.5 percent can double the cost of ownership over 20 years

- Maintenance costs, property taxes, and liquidity constraints further erode net returns

Consider the case of Rohit, a 34-year-old marketing professional in Pune. He took a Rs 70 lakh loan to buy a Rs 90 lakh flat. With an EMI of Rs 58,551, nearly half his monthly income is locked into repayments. Over 20 years, he will pay Rs 1.41 crore—of which Rs 70.5 lakh is interest. Meanwhile, the property’s market value has only risen to Rs 1.1 crore.

The Opportunity Cost of Real Estate

Now imagine if Rohit had invested that same EMI into a mutual fund SIP yielding 12 percent annually. His corpus after 20 years would be approximately Rs 5.85 crore—fully liquid, tax-efficient, and maintenance-free. Even conservative instruments like fixed deposits or liquid funds would outperform his flat in inflation-adjusted terms.

This comparison highlights a critical insight: real estate, while emotionally gratifying, may not be the most efficient wealth-building tool for salaried professionals.

Emotional Decisions Versus Financial Discipline

Many Indians buy homes driven by social pressure, fear of missing out, or the sentimental dream of “apna ghar.” This often leads to:

- Multiple properties across cities due to job transfers or family needs

- Locked capital in illiquid assets that are rarely used

- Continued rental expenses despite owning homes elsewhere

The irony is stark—people end up owning homes they don’t live in, while renting homes they do.

When Real Estate Still Makes Sense

For high-net-worth individuals (HNIs), real estate can still be a strategic asset. But the approach is fundamentally different:

- Properties are purchased without loans, avoiding interest burdens

- Portfolios are diversified across asset classes, reducing dependency on real estate

- Investments are made in high-growth zones or luxury segments with lifestyle value

In these cases, real estate serves as a wealth preservation tool rather than a primary growth engine.

The Rise Of Smarter Alternatives

As awareness grows, younger investors are exploring alternatives that offer better returns and flexibility:

- Mutual funds and SIPs for long-term compounding

- REITs and InvITs for exposure to real estate without ownership hassles

- Equity and startup investments for higher risk-adjusted returns

These instruments allow investors to stay agile, diversify risk, and grow wealth without the emotional baggage of property ownership.

Conclusion: Time To Rethink The Real Estate Obsession

India’s cultural attachment to home ownership is deep-rooted, but it’s time to separate sentiment from strategy. For the middle class, especially those relying on loans, real estate may be more of a financial trap than a wealth builder. As the economy evolves and investment options expand, rethinking the role of property in one’s portfolio could be the key to unlocking true financial freedom.

Sources: Moneycontrol, India TV News, Aurum PropTech Pulse, Knight Frank Wealth Report 2025

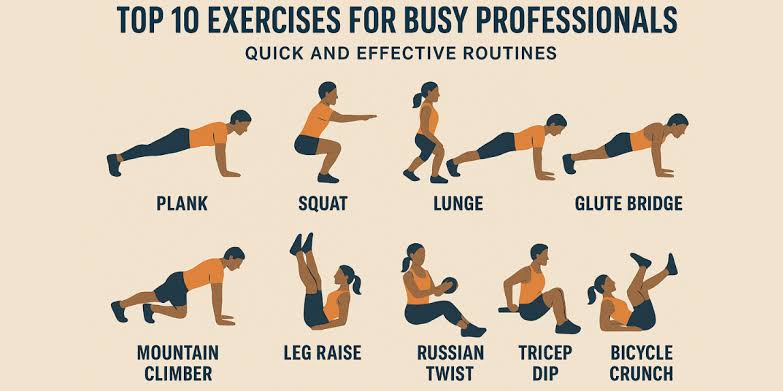

Advertisement

Advertisement