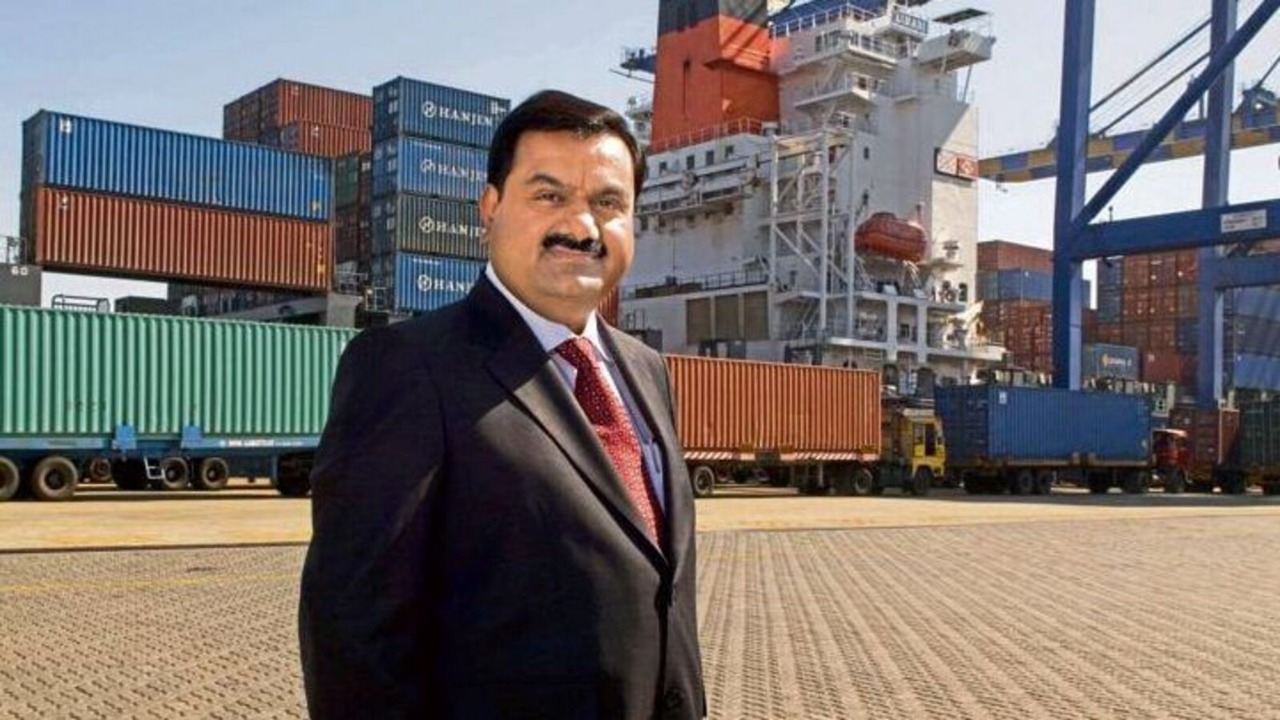

Adani Ports and Special Economic Zone (APSEZ) has emerged as one of the top ten Nifty50 companies with the highest year-on-year profit growth in the fourth quarter of FY25. The company reported a stellar 50% jump in consolidated net profit, reaching ₹3,023 crore for the March quarter, up from ₹2,025 crore a year ago. This robust growth was fueled by a 23% rise in operational revenue to ₹8,488 crore and a significant increase in cargo and container volumes.

For the full fiscal year, Adani Ports posted a record profit of ₹11,061 crore, marking a 37% increase over the previous year. The company’s operational momentum was driven by healthy cargo growth, a surge in logistics volumes, and margin expansion across core businesses. Cargo volumes for the quarter hit 117.9 million metric tonnes, up 8% year-on-year, while container volumes jumped 23%, highlighting strong demand in both domestic and international markets.

Adani Ports’ Q4 performance not only surpassed analyst expectations but also outpaced most of its Nifty50 peers. The company’s EBITDA rose 24% to ₹5,006 crore, maintaining a solid margin of 59%. This impressive showing has been recognized by leading brokerages, with several raising their target prices for APSEZ and projecting further growth in the coming years.

The broader Nifty50 landscape saw steady financial growth, but Adani Ports stood out for its exceptional bottom-line expansion, cementing its position as a key growth driver in India’s infrastructure and logistics sector.

Sources: Groww, Economic Times, Upstox