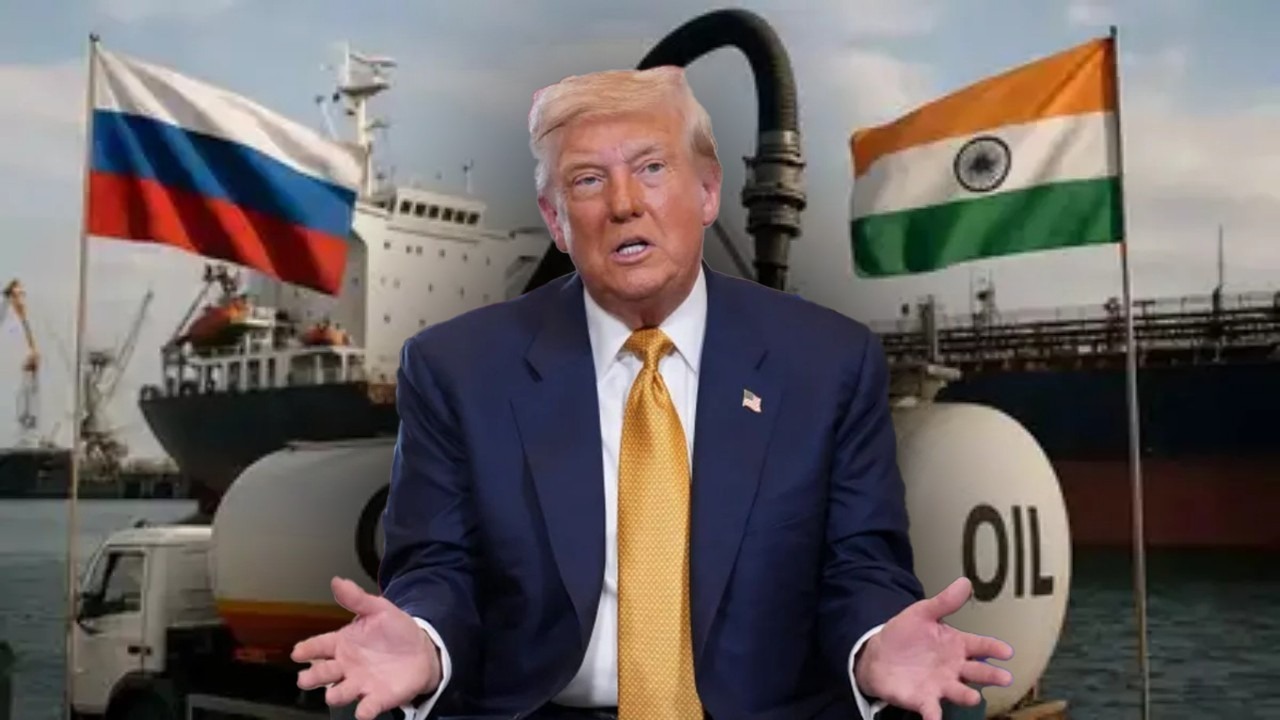

In a move that could reshape global oil trade dynamics, Indian state-run refiners have resumed placing orders for Russian crude oil, driven by widening discounts on Urals-grade barrels. After a brief pause last month due to narrowing price gaps and geopolitical uncertainty, refiners are now capitalizing on favorable economics ahead of a high-stakes meeting between US President Donald Trump and Russian President Vladimir Putin.

The renewed interest signals India’s continued strategic balancing act between energy affordability and diplomatic pressures.

Key Developments Driving The Renewed Purchases

- Indian Oil Corp, Bharat Petroleum Corp, Hindustan Petroleum Corp, and Mangalore Refinery Petrochemical Ltd have begun exploring new Russian oil deals

- Spot discounts on Russian Urals crude widened to approximately 2.70 dollars per barrel, up from 1.50 dollars in July

- The increased discount makes Russian oil more attractive compared to Middle Eastern grades

- Refiners are acting ahead of the Trump-Putin meeting, which could influence future sanctions and trade flows

- Russian oil currently accounts for over 35 percent of India’s total crude imports

Why Discounts Are Shaping India’s Oil Strategy

The widening of spot discounts on Russian Urals crude has reignited interest among Indian state refiners. Delivered prices for October-loading cargoes are now significantly cheaper than comparable grades from the Middle East and West Africa. This pricing advantage is particularly compelling for state refiners, which operate on tight margins and require cost-effective feedstock.

Factors influencing the discount trend include:

- Oversupply in global markets

- Seasonal demand slowdown

- Russia’s push to retain market share amid Western sanctions

- Competitive pricing to offset geopolitical risks

Geopolitical Tensions And Strategic Timing

The timing of these purchases is crucial. US President Donald Trump has threatened to impose secondary sanctions on countries continuing to buy Russian oil unless Moscow agrees to a peace deal with Ukraine. With a key diplomatic meeting scheduled in Alaska, Indian refiners are moving swiftly to secure discounted barrels before potential restrictions take effect.

Refinery executives have indicated that:

- Orders are being placed cautiously, with flexibility built into delivery schedules

- Decisions are being made independently, as no formal government directive has been issued

- A sudden halt in Russian imports could tighten global supply and spike prices

Impact On India’s Energy Mix And Market Dynamics

India, the world’s third-largest oil importer, relies heavily on Russian crude for its refining needs. The resumed purchases are expected to stabilize domestic supply chains and maintain refining margins. However, the move also risks attracting scrutiny from Western allies, especially if sanctions intensify.

Current market implications include:

- Potential rise in demand for Russian Urals crude

- Pressure on Middle Eastern suppliers to adjust pricing

- Increased volatility in global oil benchmarks like Brent and Dubai

- Strategic recalibration by private refiners such as Reliance and Nayara, who maintain long-term Russian contracts

Looking Ahead: What Refiners Are Watching

Indian refiners are closely monitoring:

- Outcomes of the Trump-Putin meeting

- Any new US tariffs or sanctions targeting Russian oil buyers

- Shifts in global crude pricing and freight costs

- Domestic policy signals from the Indian government regarding energy security

Executives from Bharat Petroleum and Indian Oil have stated that Russian crude could continue to form up to 35 percent of their import mix, provided no new sanctions are imposed. The next few weeks will be critical in determining whether this renewed buying trend sustains or stalls under geopolitical pressure.

Conclusion: A Calculated Bet On Crude Economics

India’s state refiners have made a calculated move to tap into discounted Russian oil, balancing economic pragmatism with geopolitical caution. As global energy markets brace for potential disruptions, India’s strategy underscores the complex interplay between affordability, diplomacy, and energy security.

Sources: Financial Express, MSN News, The Economic Times, The Hindu Business Line