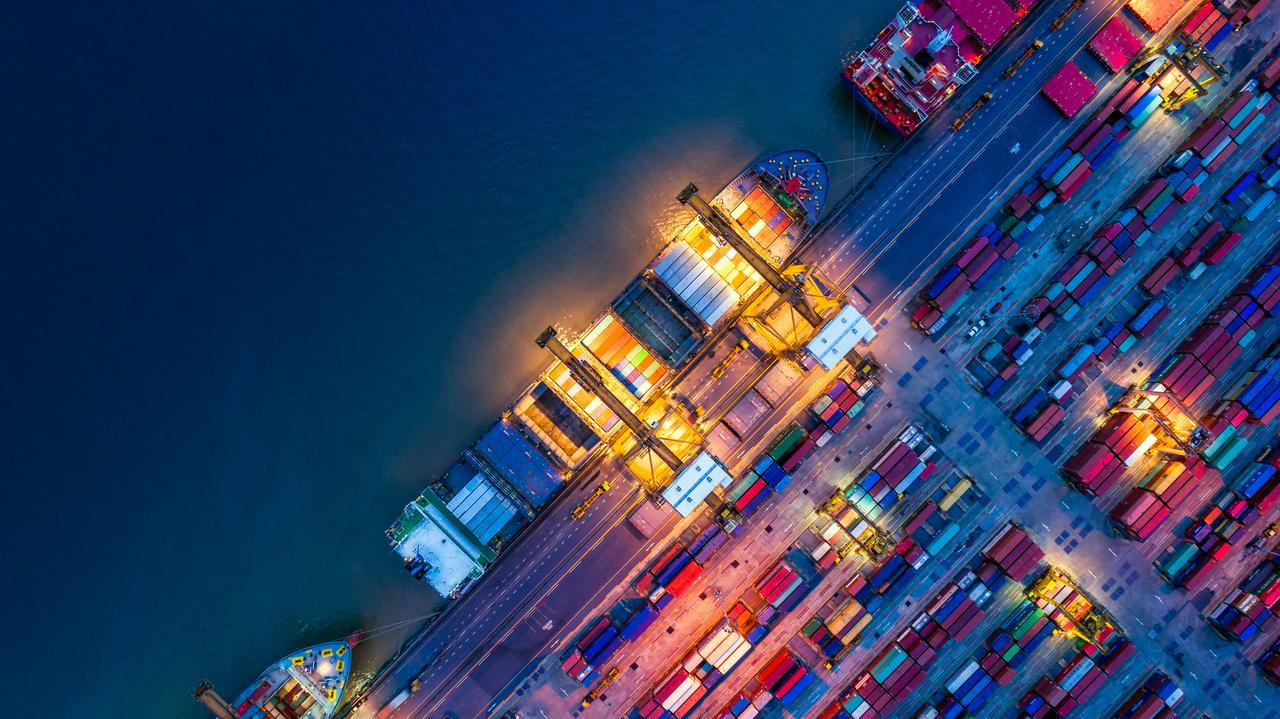

DP World, a world leader in port and logistics operations, is accelerating its expansion in Southeast Asia (ASEAN) as supply chains around the world shift due to rising Chinese offshore production. The strategic expansion is intended to capture new trade flows as producers diversify away from China, with ASEAN being a major beneficiary. The expansion is part of DP World's larger initiative to boost its global capacity and evolve in response to changing market dynamics fueled by geopolitical tensions and shifting investment trends.

Strategic Rationale for Expansion

-

Supply Chain Diversification: The restructuring of global trade is progressing apace, spurred by tariffs and geopolitical risk, and pushing manufacturers to diversify their supply chains away from China, with Southeast Asia, India, and Mexico emerging as leading alternatives.

-

China +1 Strategy: DP World is consistently championing the 'China +1' strategy, which entails growth in ASEAN nations such as Vietnam and India to enhance supply chain diversity and reduce risks.

-

Growing Chinese Investment in ASEAN: Outbound investment from China is increasingly focusing on Southeast Asia, particularly in the areas of new energy vehicles, semiconductors, and infrastructure, turning the region into a new manufacturing hub.

DP World's Expansion Plans

-

Notable Capacity Expansion: DP World aims to increase its container handling capacity across the world by 5.4 million TEUs in 2025, taking it to 107.6 million TEUs. Key ASEAN locations, such as Malaysia and the Philippines, are among the priority locations for this expansion.

-

Capital Expenditure: The company has allocated $2.5 billion for capital spending in 2025, funding initiatives in key locations throughout Asia, such as Malaysia, India, and other high-demand territories.

-

Asset-Light and Agile Operations: As a result of acquisitions such as Unifeeder and Feedertech, DP World is utilizing asset-light frameworks to rapidly respond to emerging market needs and de-risk its operations in various geographies.

Market and Regional Impact

-

ASEAN as a Manufacturing Hub: Thailand, Malaysia, and Vietnam are drawing substantial Chinese manufacturing investment, especially in automotive, electronics, and semiconductor industries.

-

Improved Trade Corridors: Investments by DP World are enabling new trade corridors between ASEAN manufacturing hubs and global consumer markets, taking advantage of the region's increasing position in international supply chains.

-

Integration with Local and Global Logistics: DP World is increasing its logistics and feeder capacity to improve the connectivity of ASEAN ports to mainline shipping lanes and inland destinations, underpinning both local and international flows.

Broader Strategic Outlook

-

Resilience In the Face of Disruption: In spite of global upheaval, DP World keeps up with solid financial performance due to operational excellence and high-margin cargo handling.

-

Investment in Emerging Markets: The expansion of the company in ASEAN is also part of a broader strategy to invest in emerging markets, solidifying its role as a global trade enabler and supply chain disruptor

Sources: Seatrade Maritime, China Briefing, India Shipping News, DP World Annual Report 2024