The Madhya Pradesh High Court has laid down the legal duty of an employer to calculate and inform the payment of gratuity within 30 days from the day it is payable regardless of whether an employee has made a formal application. This judgment supports the legislative scheme of the Payment of Gratuity Act, 1972, and seeks to provide immediate financial security to employees leaving service.

Gratuity is a statutory benefit payable to employees on the termination of their services after a continuous period of not less than five years. The subsequent verdicts of the Madhya Pradesh High Court make it clearer and more stringent that employer's obligations towards timely adjudication and payment of gratuity are made and impose penalties for failure.

Employer's Mandatory Duty

-

Employers should decide the gratuity amount and send a written communication to the employee and the governing authority as soon as gratuity becomes due, whether or not the employee has sought it.

-

The employer is under an automatic duty to pay gratuity from the date the employee retires on completion of the requisite period of service (usually five years) on grounds of superannuation, retirement, resignation, death, or disablement.

30-Day Payment Window

-

The employer is statutorily obliged to make payment of the gratuity amount calculated within 30 days from the date it falls due.

-

Delay in payment within this timeline incurs mandatory interest on the delayed gratuity amount until the payment date.

Interest and Penalties for Delay

-

If gratuity is not paid within 30 days, the employer has to pay simple interest on the amount due, as provided under Section 7(3A) of the Act.

-

Non-payment or delayed payment of gratuity may also attract penal sanctions in the form of imprisonment and fines, under Section 9 of the Act.

Dispute Resolution

-

In the event of any dispute over the amount or admissibility of gratuity, the employer shall deposit the admitted amount with the controlling authority, which shall decide the case.

-

The right to receive gratuity and interest is absolute and not subject to any limitation period or filing of an application by the employee.

Eligibility and Calculation

Employees become eligible for gratuity after five years of continuous service, subject to some exceptions (death or disablement).

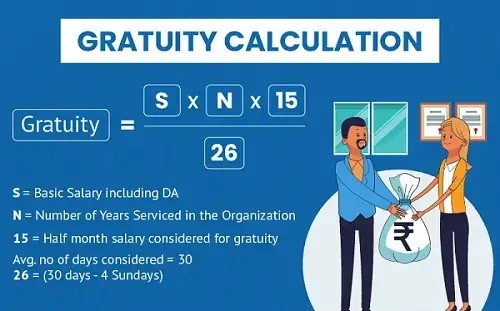

The gratuity is worked out on the last drawn salary and the number of years served using a basic formula

Multiply:

Last Drawn Salary x Years of Service x 15

Divide this with 26

Summary Statement

The High Court's decision reaffirms that the burden of deciding and paying gratuity rests squarely with the employer and must be done within 30 days of when the benefit fell due. There is no need for employees to file an application for gratuity to initiate such a requirement. Delay beyond the prescribed time amounts to compulsory interest payments and may attract severe penalties, such as imprisonment and fines. This ruling seeks to safeguard the rights of workers and guarantee them on-time payment of their statutory benefits.

Sources: Madhya Pradesh High Court Order (March 21, 2025) Madhya Pradesh High Court Order (April 15, 2025) Drishti Judiciary - Forfeiture of Employee's Gratuity Economic Times - Gratuity Payment Rules SCC Online - Tripura HC on Gratuity Payment and Interest