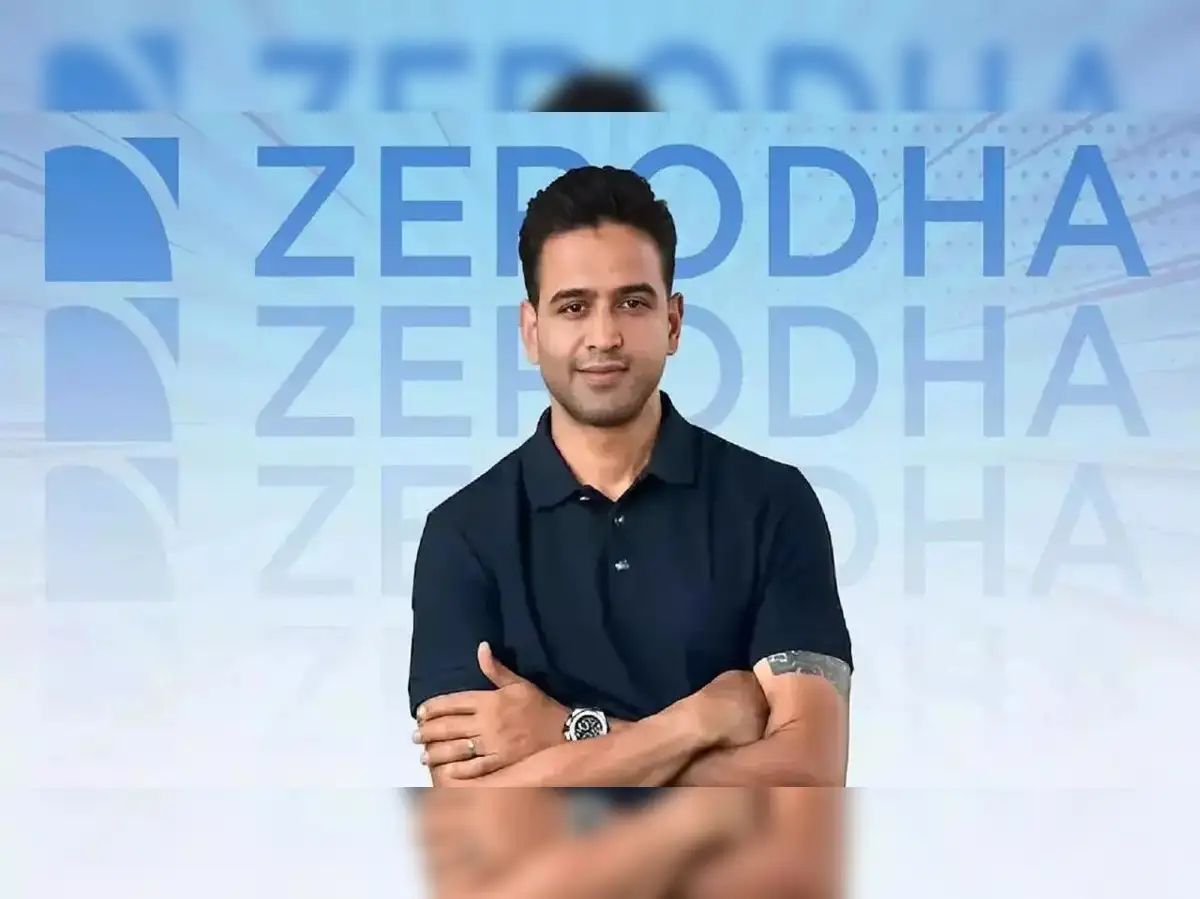

Image Source: Economic Times

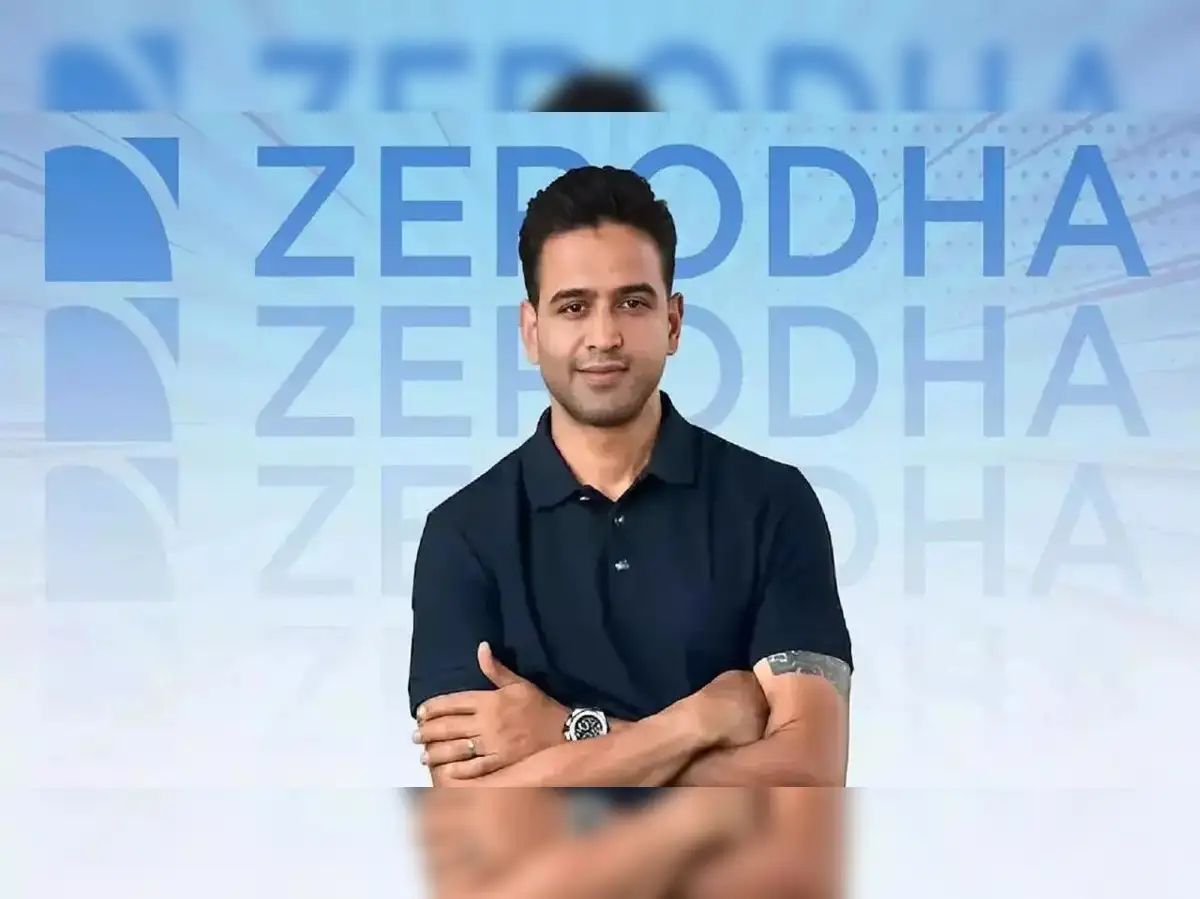

Image Source: Economic Times

A Quiet Revolution in Market Efficiency

In a recent detailed discourse, Zerodha co-founder and CEO Nithin Kamath highlighted a pivotal yet unheralded regulatory reform by the Securities and Exchange Board of India (SEBI) that has quietly transformed the infrastructure of India’s capital markets. This backend upgrade, far from the public eye and lacking flashy user interfaces, has produced substantial operational efficiencies and reduced systemic risks—indirectly funneling significant gains to retail investors.

Key Highlights of SEBI’s Invisible Reform and Its Impact

SEBI undertook a multi-year project to unify and standardize data exchanges across multiple market entities such as stock exchanges, depositories, registrars and transfer agents (RTAs), banks, and more.

This reform introduced Uniform Distilled File Formats (UDiFF), harmonizing data structures and file formats used in trade, settlement, reporting, and other processes that were previously heterogeneous and inconsistent.

For brokers like Zerodha, this data standardization eliminated a substantial portion (over 60%) of the complex, redundant coding needed to translate between disparate formats, drastically reducing operational and technical complexity.

Critical operational processes accelerated massively; for example, nightly data imports shrank from 40 minutes to just 30 seconds, reflecting massive efficiency gains.

The systemic cleanup of decades-long technical debt minimized operational risks and lowered chances of errors, benefiting all market participants, especially retail investors who rely on seamless trade execution and timely settlement.

Kamath emphasized that such regulatory backend work, though “boring” and “invisible,” is far more impactful over the long term than many flashy front-end features or user-facing innovations.

Zerodha’s engineering philosophy mirrors this perspective, prioritizing robustness, reliability, and continuous technical debt reduction to sustain market operations resiliently over the next decade.

This systemic efficiency ultimately translates into smoother investor experiences, fewer transaction delays, and higher market confidence, empowering retail investors indirectly yet powerfully.

Understanding the Complexity Behind the Scenes

Kamath shed light on the staggering complexity brokers handle behind the scenes, integrating with hundreds of APIs and file exchanges spread across multiple stock exchanges, clearing corporations, depositories (NSDL, CDSL), RTAs, and banks. Until SEBI’s reform, the lack of uniformity required maintaining multiple data translations and reconciliation mechanisms, increasing the risk of glitches and delays.

How Retail Investors Benefit from SEBI’s Step

Faster data processing means trades get settled quicker, reducing settlement risk and improving capital efficiency for investors.

Consistency and reduced errors in market data increase reliability and transparency, thereby improving investor trust.

Reduced operational disruptions decrease transaction costs subtly embedded in delays or failures, indirectly enhancing investor returns.

Minimizing technical and systemic risk fosters a healthier market ecosystem, encouraging greater participation from retail investors.

Harmonized data flows enable brokers to innovate on services and invest in user experience without being bogged down by backend chaos.

Zerodha’s Commitment to Operational Excellence

Echoing SEBI’s reforms, Nithin Kamath revealed Zerodha’s internal commitment to tackling their own operational debt rigorously. With a focus on making underlying systems scalable and resilient, Zerodha aims to provide its vast retail user base with a market infrastructure that works behind the scenes smoothly and efficiently, rather than chasing short-term feature launches.

The emphasis on invisible improvements shows an engineering culture that values systemic health over quick fixes, creating a stable foundation for future growth and innovation in India’s retail investing landscape.

Conclusion: The Overlooked Backbone of Retail Market Gains

Nithin Kamath’s insights spotlight the profound yet understated role that regulatory and systemic technical reforms play in shaping the fortunes of retail investors. The quiet implementation of uniform data standards by SEBI has created a robust and efficient capital market framework which brokers and investors alike benefit from substantially.

This behind-the-scenes revolution reaffirms that while visible innovations attract user attention, it is often these “boring” invisible infrastructural upgrades that deliver genuine long-term windfall gains by enhancing market integrity, speed, and reliability.

Sources: Economic Times, Zerodha Pulse

Advertisement

Advertisement