Image Source: Mint

Image Source: Mint

India’s entrepreneurial engine is roaring louder than ever. The fifth edition of the Unicorn and Future Unicorn Report 2025, jointly released by Ask Private Wealth and Hurun India, has unveiled a compelling snapshot of the country’s most valuable private startups. From fintech disruptors to quick-commerce pioneers, the top 20 unicorns reflect a dynamic mix of innovation, scale, and investor confidence.

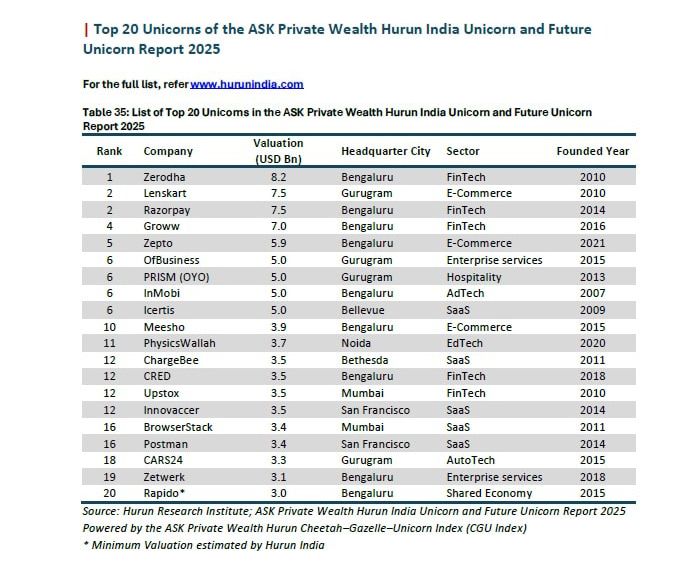

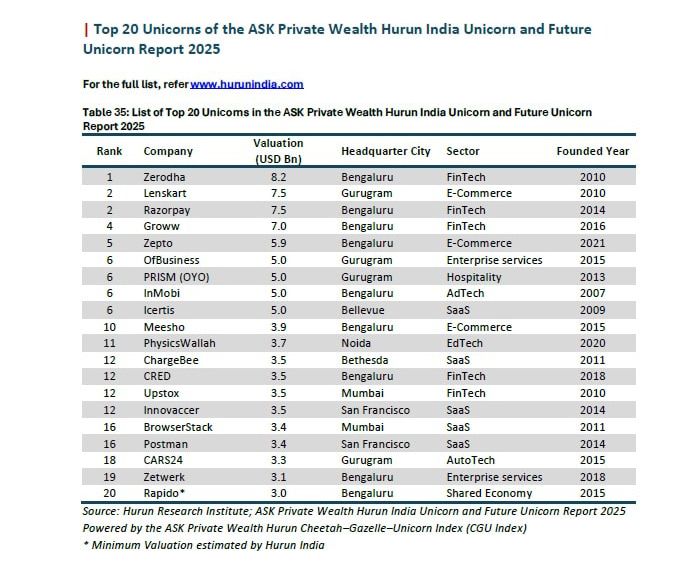

Top 20 Unicorns of 2025: A Glimpse into India’s Startup Elite

Zerodha – Valued at $8.2 billion, this bootstrapped fintech firm tops the list, revolutionizing retail investing with low-cost trading platforms.

Razorpay – A $7.5 billion digital payments leader enabling seamless transactions for businesses across sectors.

Lenskart – With a $7.5 billion valuation, this eyewear giant blends online retail with brick-and-mortar presence.

Groww – A $7 billion investment platform that has seen 119 percent revenue growth, reflecting India’s appetite for financial inclusion.

Zepto – The youngest entrant, valued at $5.9 billion, scaling instant grocery delivery with 120 percent revenue growth.

InMobi – A $5 billion mobile advertising powerhouse with global reach.

OfBusiness – A $5 billion B2B marketplace streamlining enterprise procurement and financing.

Icertis – A SaaS unicorn valued at $5 billion, specializing in contract lifecycle management.

PRISM (OYO) – Hospitality disruptor with a $5 billion valuation and $3.7 billion in cumulative funding.

Meesho – E-commerce innovator valued at $3.9 billion, empowering small sellers across India.

CRED – A fintech platform focused on premium credit users, now a billion-dollar entity.

Navi Technologies – A digital lending and insurance startup breaking into the unicorn club.

Vivriti Capital – A financial services firm offering structured debt solutions.

Rapido – A mobility platform expanding bike taxi services across urban India.

Netradyne – AI-powered fleet management and driver safety solutions.

Jumbotail – A B2B food and grocery marketplace serving small retailers.

DarwinBox – A cloud-based HR tech platform for enterprise clients.

Moneyview – A personal finance app offering credit and budgeting tools.

Veritas Finance – Lending solutions tailored for micro and small enterprises.

Drools – A pet food brand scaling rapidly in India’s growing pet care market.

Key Highlights from the Report

India now hosts 73 unicorns and 150 future unicorns, up from 82 in 2021.

Ai.tech emerged as the fastest unicorn, reaching the milestone in just three years.

Real-money gaming startups like Dream11, MPL, and Gameskraft exited the list due to regulatory headwinds from the Online Gaming Bill 2025.

Cumulative valuations of cheetahs and gazelles surged 79 percent to $62 billion.

Investor participation expanded dramatically, from 182 in 2021 to 1,014 in 2025.

Peak XV Partners leads the investment pack with 42 active bets.

Sectoral Trends and Emerging Themes

Fintech, SaaS, and consumer tech continue to dominate the unicorn landscape.

AI, SpaceTech, and New Energy sectors are gaining traction, growing from nine companies in 2022 to 19 in 2025.

New Energy startups saw a staggering 1,389 percent valuation growth in three years.

SpaceTech startups collectively built a $1.8 billion presence, signaling India’s ambitions in orbital innovation.

Geographic Concentration and Employment Impact

Bengaluru remains the epicenter of India’s startup ecosystem, hosting 26 unicorns valued at $70 billion.

Employment across cheetahs and gazelles nearly doubled, now supporting 167,000 jobs.

Revenue from these future unicorns grew more than sixfold, from ₹9,955 crore in 2021 to ₹68,277 crore in 2025.

Voices from the Ecosystem

Rajesh Saluja, CEO of Ask Private Wealth, emphasized the shift toward profitability and capital efficiency, noting that India’s startup ecosystem is now a global force in innovation. Anas Rahman Junaid, Chief Researcher at Hurun India, highlighted the importance of tracking unicorns as indicators of economic transformation and global capital attraction.

Conclusion

The Unicorn Report 2025 is more than a ranking—it’s a reflection of India’s evolving innovation pipeline. With young founders, bootstrapped success stories, and deep investor interest, the country is poised to shape the next wave of global disruptors.

Sources: MSN News, Livemint2, Outlook Business, NDTV Profit

Advertisement

Advertisement