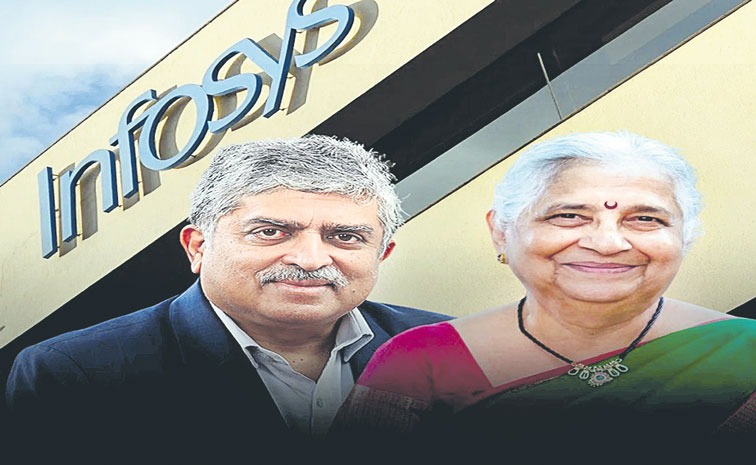

Infosys promoters, including Nandan Nilekani and Sudha Murty, have opted out of the company’s ₹18,000-crore share buyback. Their decision signals long-term confidence in Infosys and will slightly increase their stake post-buyback. The move aligns with past practices and reflects strategic governance choices by the promoter group.

Promoters choose to hold, not sell

In a notable development, Infosys promoters and members of the promoter group—including co-founders Nandan Nilekani and NR Narayana Murthy’s wife Sudha Murty—have decided not to participate in the company’s largest-ever ₹18,000-crore share buyback. The decision was communicated through formal letters submitted between September 14 and 19, 2025, as per regulatory filings.

As of the buyback announcement date, promoters collectively held a 13.05% stake in Infosys. By opting out, their shareholding is expected to rise marginally to 13.37%, assuming full subscription by public shareholders. This move will also slightly reduce public ownership from 86.95% to 86.63%.

Strategic implications for governance

The decision to abstain from the buyback is consistent with previous buyback cycles, where promoters have chosen to retain their holdings. Analysts interpret this as a vote of confidence in Infosys’ long-term growth and stability. It also ensures that the promoter group maintains a steady influence over corporate governance and strategic direction.

The buyback, aimed at enhancing shareholder value and optimizing capital structure, is open to public shareholders. Infosys has stated that depending on the response, the voting rights of the promoter group may shift slightly, but their overall influence remains intact.

Key highlights from the buyback announcement

- Infosys promoters opt out of ₹18,000-crore share buyback

- Promoter group includes Nandan Nilekani, Sudha Murty, and family members

- Promoters currently hold 13.05% stake, expected to rise to 13.37% post-buyback

- Public shareholding to dip slightly from 86.95% to 86.63%

- Decision aligns with past buyback cycles and governance strategy

- Buyback open to public shareholders to enhance capital efficiency

- Promoter abstention signals long-term confidence in Infosys

- Regulatory filings submitted between September 14–19, 2025

Sources: MSN News, Moneycontrol, Times of India, Livemint