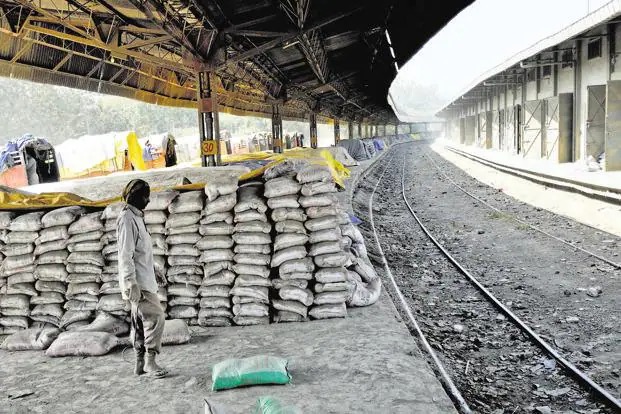

Image Source: Mint

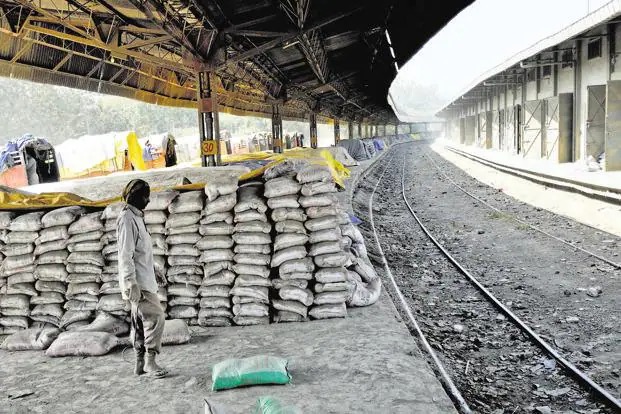

Image Source: Mint

Shree Cement Ltd, one of India’s leading cement manufacturers, has reported its financial results for the first quarter of FY26. The company posted a consolidated profit of ₹6.19 billion, surpassing analyst expectations, while revenue from operations came in at ₹49.48 billion, slightly below the consensus estimate of ₹51.71 billion. The results reflect a strong operational performance and cost discipline, even as top-line growth faced headwinds.

This newsletter provides a detailed analysis of the company’s quarterly performance, segmental trends, and strategic outlook.

Key Highlights from Q1 FY26

- Consolidated revenue from operations stood at ₹49.48 billion

- Net profit for the quarter reached ₹6.19 billion, exceeding the I/B/E/S estimate of ₹5.43 billion

- EBITDA margins improved year-on-year, driven by lower fuel costs and operational efficiencies

- Volume growth remained steady, supported by demand in infrastructure and housing sectors

- The company maintained a conservative debt profile and strong cash reserves

Revenue Performance and Market Dynamics

Shree Cement’s revenue of ₹49.48 billion for the June quarter fell short of analyst expectations but still reflects a stable performance amid mixed demand conditions. The slight miss was attributed to:

1. Softer realization in key northern and eastern markets

2. Monsoon-related disruptions in construction activity

3. Competitive pricing pressure from regional players

Despite these challenges, the company maintained its leadership position in core markets and continued to expand its distribution footprint.

Profitability and Cost Management

The standout aspect of Shree Cement’s Q1 results was its net profit of ₹6.19 billion, which beat consensus estimates by a wide margin. This was driven by:

1. Decline in pet coke and coal prices, reducing energy costs

2. Improved plant utilization and logistics optimization

3. Strategic sourcing and inventory control measures

EBITDA margins improved to approximately 24 percent, reflecting the company’s focus on operational efficiency and cost discipline.

Production and Capacity Utilization

Shree Cement’s production volumes remained robust, supported by high utilization rates across its plants. The company continues to invest in capacity expansion, with new clinker and grinding units under development in Rajasthan and Chhattisgarh.

1. Total cement sales volume grew modestly year-on-year

2. Utilization rates exceeded 85 percent across most facilities

3. Expansion projects are on track for commissioning in FY26

Strategic Initiatives and Sustainability Focus

The company remains committed to its long-term strategy of sustainable growth and operational excellence. Key initiatives underway include:

- Transition to renewable energy sources across manufacturing units

- Investment in waste heat recovery systems and green logistics

- Digitization of supply chain and customer engagement platforms

- Continued focus on low-carbon cement technologies

Shree Cement’s sustainability roadmap aligns with global ESG benchmarks and positions it as a responsible industry leader.

Investor Sentiment and Market Response

The market has responded positively to Shree Cement’s Q1 profit beat, with analysts highlighting its strong margin performance and disciplined cost structure. The revenue miss was seen as a temporary setback, with expectations of recovery in the second half of the fiscal year.

Outlook for FY26

Looking ahead, Shree Cement is expected to benefit from:

- Increased infrastructure spending under government initiatives

- Recovery in rural housing demand post-monsoon

- Stabilization of input costs and improved pricing environment

- Continued capacity expansion and operational leverage

Conclusion: A Profitable Quarter with Strategic Resilience

Shree Cement’s Q1 FY26 results underscore its ability to deliver strong profitability even amid revenue headwinds. With a focus on cost efficiency, sustainability, and capacity growth, the company remains well-positioned to navigate industry challenges and capitalize on emerging opportunities in the construction and infrastructure sectors.

Sources: Economic Times, Business Standard, Reuters India, Shree Cement Corporate Filings

Advertisement

Advertisement