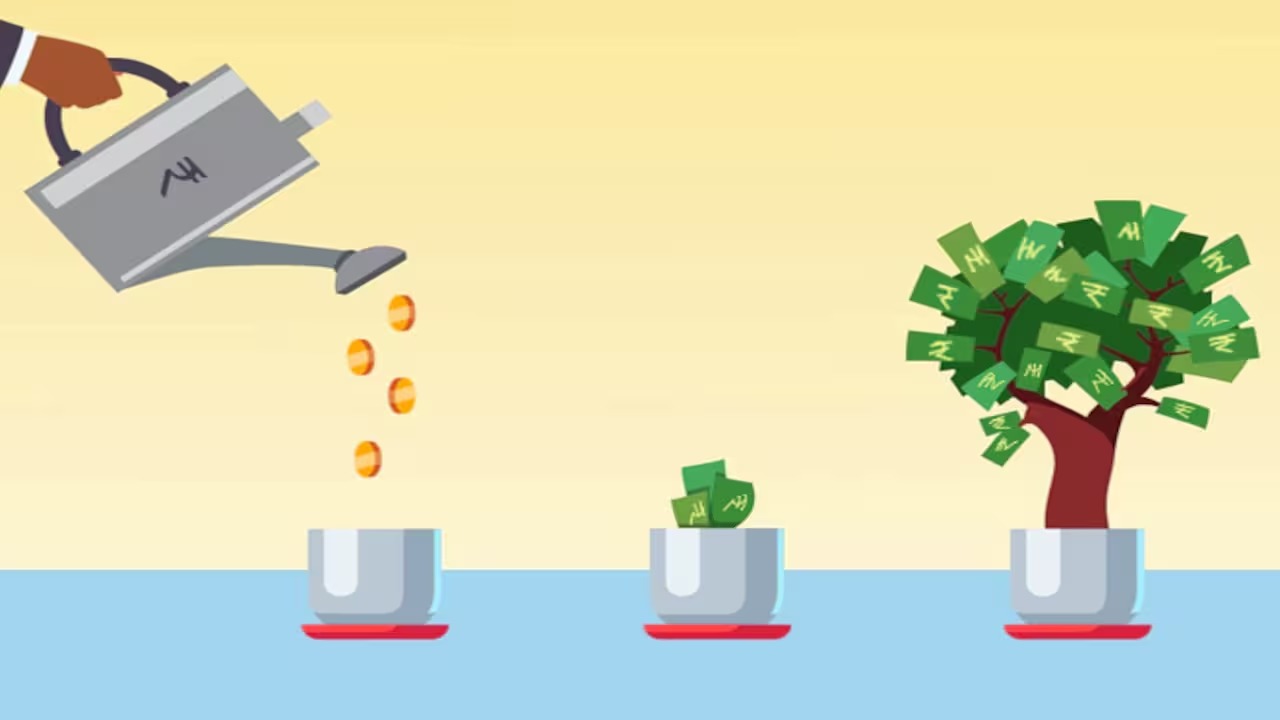

Financial planners and wealth strategists are spotlighting how disciplined monthly investing of ₹5000 can compound into substantial long-term gains, especially for young earners in India.

Wealth-Building Blueprint:

- Start with SIPs in diversified mutual funds or index funds for market-linked growth

- Use the Post Office Monthly Income Scheme or NPS for low-risk, retirement-focused returns

- Allocate a portion to digital gold or sovereign gold bonds for inflation protection

- Build an emergency fund in high-interest savings or liquid funds

- Explore side hustles or passive income to boost monthly contributions over time

Growth Outlook:

- With consistent investing and reinvestment, ₹5000 monthly can grow to ₹1 crore in 20–25 years

- Early starters benefit from compounding and market cycles

- Financial literacy and goal-based planning are key to sustaining momentum

Sources: PayBima Investment Guide 2025, GeeDee Wealth Planner Series, Chegg India Financial Roadmap, Economic Times Personal Finance Desk, Business Standard Wealth Tracker