Key Highlights

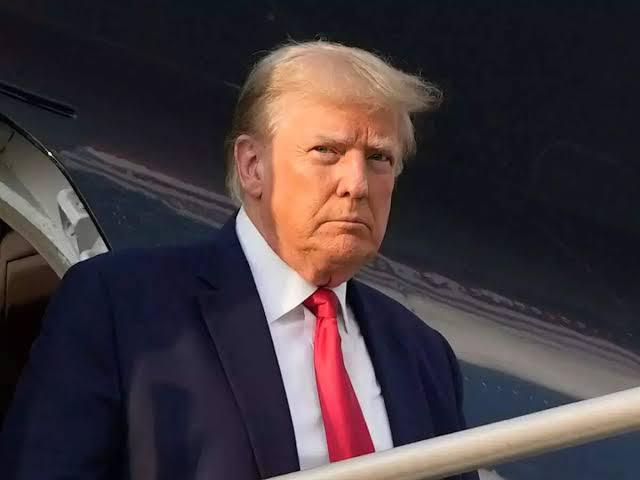

President Donald Trump announced a sweeping 50% tariff on all copper imports, a move designed to shield U.S. factories from what he called unfair foreign competition. This follows a Section 232 investigation and aligns copper with existing high tariffs on steel and aluminum. Copper futures surged as much as 17% in response, with industry watchers warning of potential price hikes for electronics, automobiles, and machinery.

Trump also revealed that tariffs of up to 200% are being considered for pharmaceutical imports, giving companies about 18 months to shift supply chains back to the U.S. before the measures take effect. The President argued this would bolster domestic drug manufacturing and reduce reliance on foreign sources.

The White House is preparing to roll out new tariffs on semiconductors, though details on targeted countries or companies remain undisclosed. The move is expected to impact global chipmakers and escalate trade tensions, especially with key Asian exporters.

Trump confirmed that BRICS nations will soon face a 10% tariff on their exports to the U.S., citing concerns over the bloc’s efforts to undermine the dollar’s global dominance. He also warned that some countries could see import duties rise as high as 70%, depending on their trade relationships and policy actions.

On the defense front, Trump reiterated calls for allies like South Korea to pay more for U.S. military protection and said he is urging multiple countries to increase their financial contributions to shared security arrangements.

The administration’s tariff blitz comes as letters were sent to 14 major trading partners, warning that new tariffs will take effect August 1 unless trade deals are finalized. Wall Street reacted with a dip in major indices and a rise in the U.S. dollar, reflecting investor uncertainty over the global economic impact.

Sources: Economic Times, Capital Brief, CNN, Moneycontrol, Bloomberg, Reuters