Follow WOWNEWS 24x7 on:

Updated: July 15, 2025 08:04

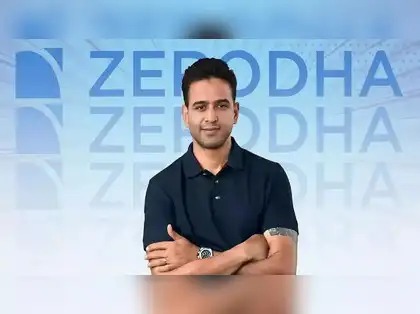

Zerodha CEO Nithin Kamath sounded the warning bell last week on India's structurally long-only equity market, alerting that the absence of short-selling infrastructure is skewing price discovery and hindering market efficiency. His alert, posted on July 14, 2025, has renewed debate around overhauling India's trading environment.

Key Highlights

- Kamath feels that short sellers are a vital part of eliminating overpriced stocks and restoring order, likening them to market janitors

- India's short-selling infrastructure is primarily offline, with stock lending under Securities Lending and Borrowing (SLB) as telephone-based requests

- Zerodha plans to launch a fully online SLB platform by year-end to simplify access and scale participation.

Structural Challenges

- Short selling can be undertaken through Futures and Options (F&O) even for only 224 stocks, which restricts the facility of investors to short or hedge poor stocks

- Expiry and rollover charges every month render F&O contracts ineffective for maintaining short positions

- SLB's off-exchange character dissuades institutional and retail participation, producing a talent shortage for short-selling strategies

.

Market Impacts

- Kamath warns that in the absence of reform, Indian markets will continue to be beset with over-valuation and inefficient pricing

- He supports relaxing regulation and digital integration to democratize short selling

- SEBI is also looking at expanding the universe of shortable stocks and streamlining the SLB disclosures

Investor Sentiment

- Kamath's comments come after broader concerns of market rigging and the need for transparency - His stance is in line with calls for a more balanced, fact-based trading platform.

Sources: Economic Times, Financial Express, Business Today, Hindu BusinessLine, LiveMint.