Image Source: BW BusinessWorld

Image Source: BW BusinessWorld

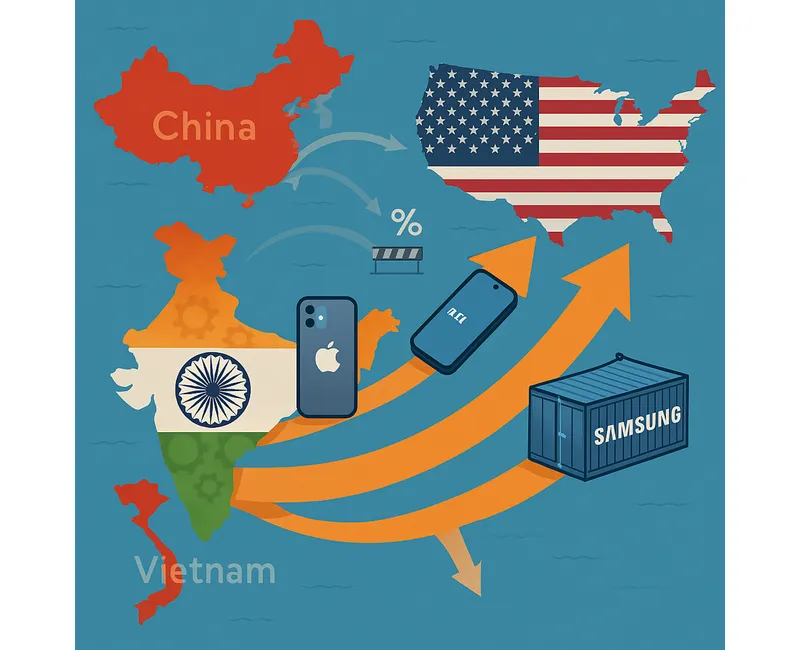

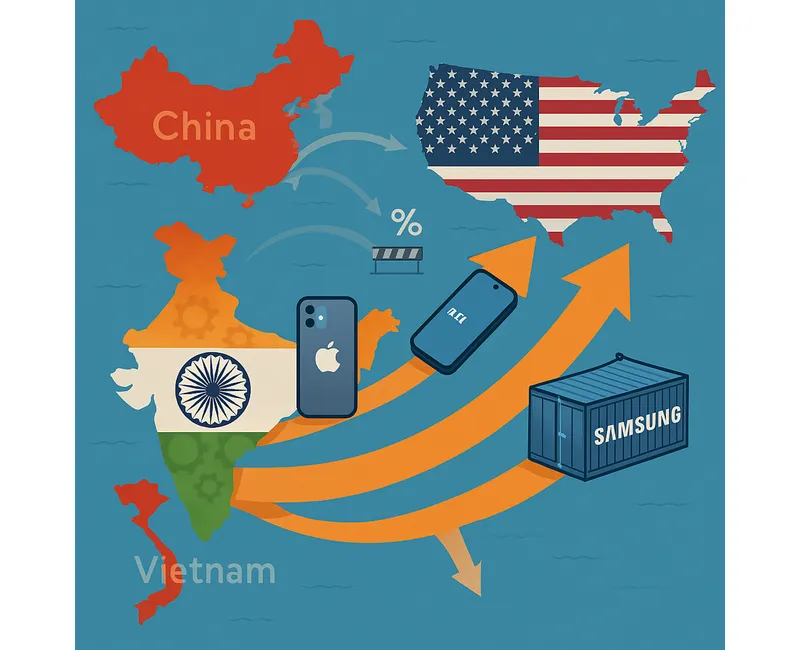

India has officially overtaken China to become the largest supplier of smartphones to the United States in the June 2025 quarter. This milestone marks a dramatic shift in global supply chains, driven by geopolitical tensions, strategic manufacturing pivots, and the accelerating momentum of India’s electronics sector.

Key Developments at a Glance

-

India accounted for 44 percent of US smartphone imports in Q2 2025, up from just 13 percent a year ago

-

China’s share fell sharply to 25 percent, down from 61 percent in the same period last year

-

Apple’s aggressive shift in iPhone assembly to India played a pivotal role

-

Total shipments of Indiamade smartphones to the US rose 240 percent yearonyear

The Apple Effect and Strategic Realignment

Apple’s decision to expedite its supply chain shift from China to India has been the single largest driver of this transformation. Amid ongoing trade uncertainties between Washington and Beijing, Apple has leaned into its China Plus One strategy, scaling up production in India through partners like Foxconn and Tata Electronics.

-

India now manufactures and exports even the complex iPhone Pro models

-

Apple has dedicated most of its Indian export capacity to serve the US market in 2025

-

iPhone exports from India to the US peaked in March, ahead of anticipated tariff hikes

-

Samsung and Motorola have also increased their Indiabased exports, though at a slower pace

Base Effect and Tariff Dynamics

The term "base effect" refers to the statistical impact of comparing current data to a low base from the previous year. In this case, India’s low export base in 2024 magnified the growth rate in 2025, but the underlying shift is real and structural.

-

US smartphone shipments from China dropped due to tariff concerns and trade negotiations

-

India captured most of this decline, becoming the preferred alternative for USbound production

-

The Trump administration’s deferred reciprocal tariffs added urgency to Apple’s pivot

India’s Manufacturing Boom

India’s electronics manufacturing sector has seen explosive growth over the past decade, supported by government incentives and foreign direct investment.

-

Mobile manufacturing units in India rose from 2 in 2014–15 to over 300 in 2024–25

-

Mobile phone production grew 28fold to ₹5.45 trillion

-

Exports surged 127 times to ₹2 trillion

-

The sector attracted over $4 billion in FDI since FY21, with Apple alone contributing $1.49 billion through Foxconn’s expansion

China’s Decline and Competitive Response

China’s dominance in smartphone exports to the US has eroded significantly.

-

Its share fell from 82 percent in early 2024 to just 49 percent in 2025

-

Chinese manufacturers have begun slashing prices to stay competitive

-

Average export prices to the US dropped 45 percent in June compared to last year

-

Smartphone shipments from China to the US fell 71 percent in June alone

Geopolitical Undercurrents and Future Outlook

While India celebrates its new status, the geopolitical landscape remains volatile. US President Donald Trump has threatened a 25 percent tariff on Indianmade iPhones, pressing for a return of manufacturing to US soil. Despite this, Apple and other tech giants appear committed to India as a longterm base.

-

India’s rise is not just a statistical anomaly but a strategic realignment

-

The country is now central to global smartphone supply chains

-

Vietnam trails behind with a 14 percent share, but India’s momentum is unmatched

Closing Thought

India’s ascent as the top smartphone supplier to the US is more than a headline—it’s a signal of shifting global power dynamics in manufacturing. With Apple leading the charge and other OEMs following suit, India’s role in the tech supply chain is no longer peripheral. It’s pivotal.

As trade tensions persist and supply chains diversify, India’s manufacturing story is just beginning. The next chapter could see even more disruption—and opportunity.

Source: Economic Times Manufacturing

Advertisement

Advertisement