Adani Green Energy has crossed the $100 billion market capitalization mark, becoming one of the world’s most valuable renewable energy companies. The surge comes amid a wave of ESG-focused investments and growing global demand for clean energy infrastructure.

What’s Driving the Growth

-

The company’s market cap milestone reflects investor confidence in its aggressive expansion strategy and integrated green energy value chain

-

ESG funds have ramped up allocations to Adani Green, citing its leadership in solar, wind, and green hydrogen projects

-

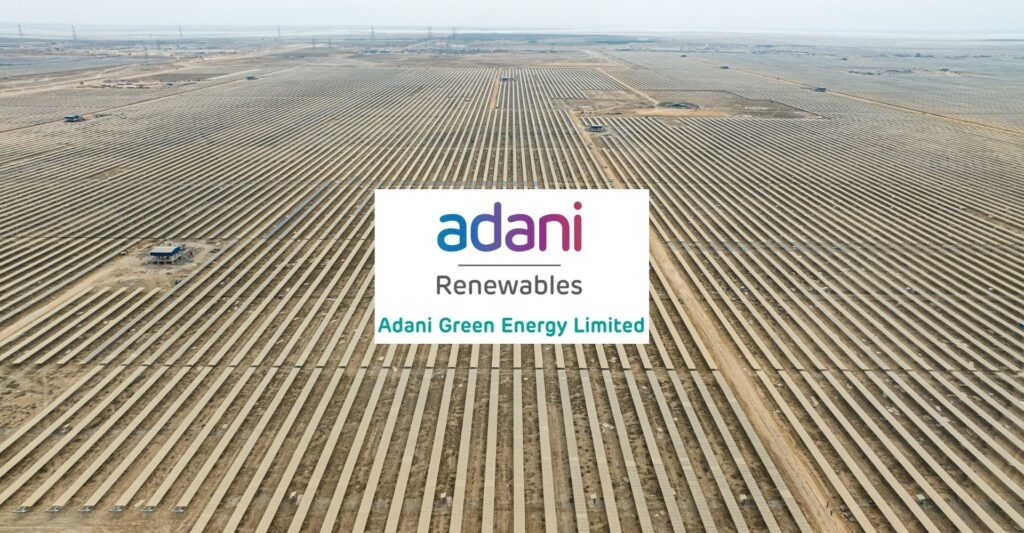

The firm is building the world’s largest single-site renewable energy park in Khavda, Gujarat, expected to generate 30 GW of power by 2030

Strategic Investments and Future Plans

-

Adani Group has committed over $100 billion to energy transition projects over the next decade

-

Investments span solar panel and wind turbine manufacturing, electrolyzer production, and green hydrogen infrastructure

-

The company aims to produce the world’s least expensive green electron, positioning itself as a global supplier for sustainable industries

Market and Policy Context

-

India’s target of 500 GW renewable capacity by 2030 aligns with Adani Green’s roadmap

-

The global energy transition market, valued at $3 trillion in 2023, is projected to double every decade through 2050

-

Adani’s digital infrastructure push—including AI-powered data centers—adds another layer of demand for clean energy

Looking Ahead

-

Analysts expect continued inflows from ESG funds and sovereign investors

-

The milestone signals India’s growing influence in the global clean energy race

Sources: Economic Times, Power Technology, Business Today, CompaniesMarketCap.com.