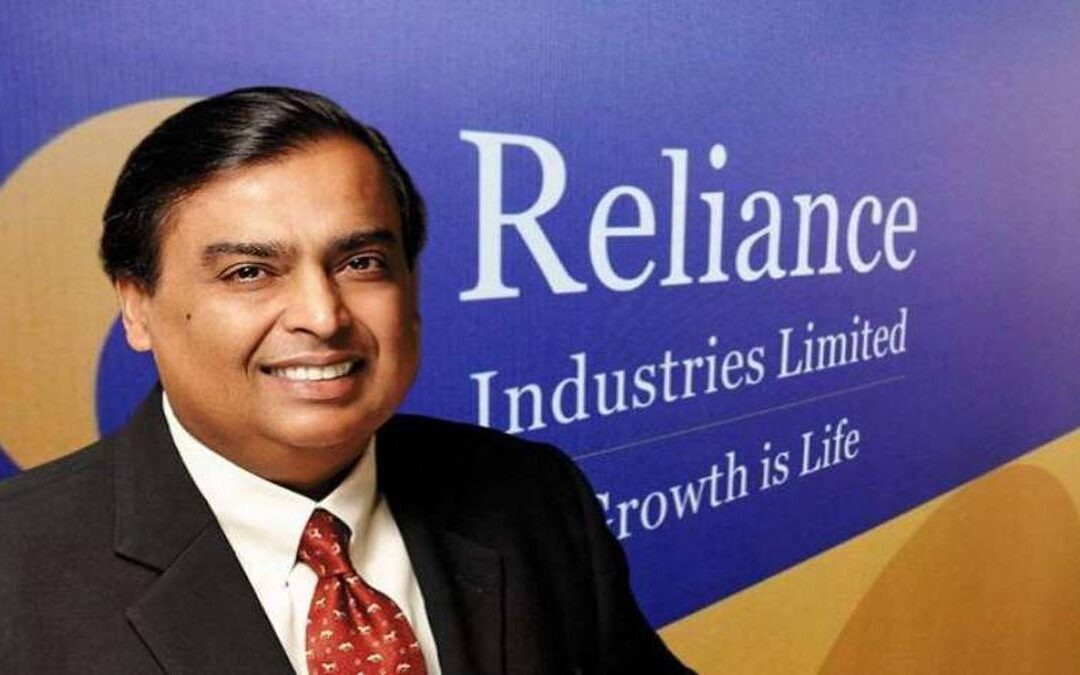

Image Source : Asia Insurance Post

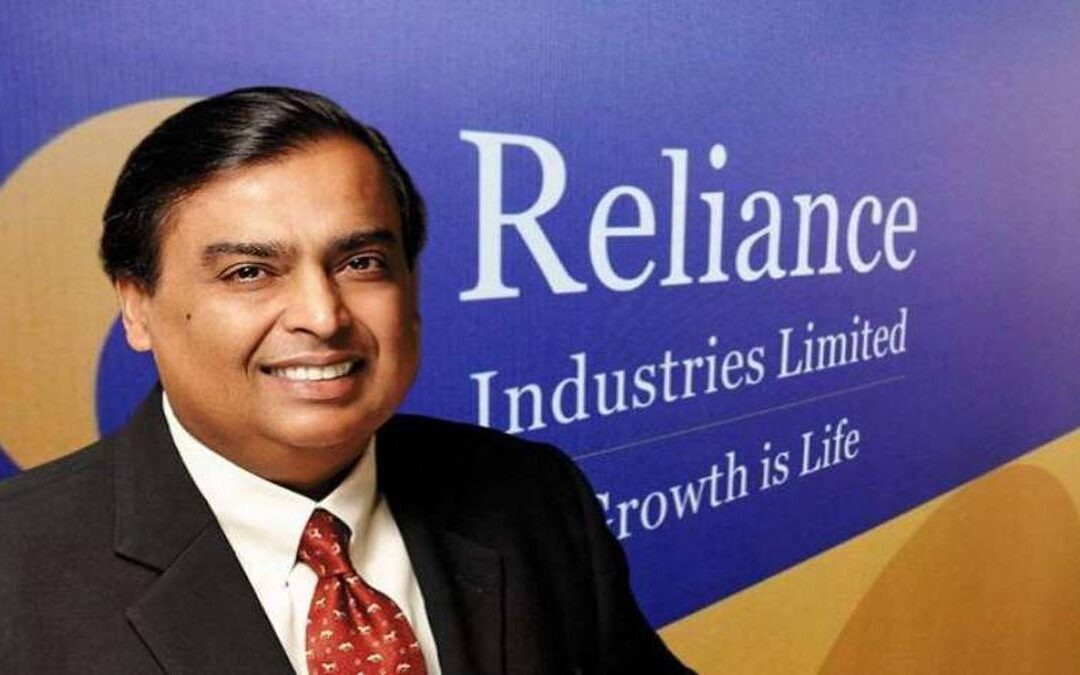

Image Source : Asia Insurance Post

Mukesh Ambani is charting a bold new course by separating Reliance Industries’ financial services arm into a standalone entity—Jio Financial Services (JFS). With a turnover of ₹1,387 crore in FY22 and ambitions to scale rapidly, the move marks a strategic pivot toward consumercentric finance and digital innovation.

Key Highlights From the Demerger Strategy

JFS will be housed under Reliance Strategic Investments, an RBIregistered NBFC, and listed independently

RIL shareholders will receive one JFS share for every RIL share held, ensuring seamless value transition

The ₹44,000 crore valuation reflects the segment’s potential despite being the smallest contributor to RIL’s revenue

Ambani’s Vision for JFS

-

Plans include entering insurance, payments, mutual funds, and digital broking within three years

-

JFS aims to offer simple, affordable, and intuitive financial products to all Indians, with a digitalfirst approach

-

The company will explore organic growth, joint ventures, and acquisitions to accelerate expansion

-

Regulatory licenses for key verticals are already secured, enabling swift execution

Strategic Context and Market Implications

-

The move aligns with Ambani’s broader succession and restructuring roadmap, ensuring focused leadership across verticals

-

It positions JFS to compete with emerging financial giants like Adani and Tata, who are also expanding in fintech

-

The demerger allows Reliance to unlock shareholder value and streamline operations across its sprawling empire

Future Path

JFS is poised to redefine financial inclusion in India. With Ambani’s backing and digital infrastructure, the spinoff could become a transformative force in the country’s financial landscape.

Sources: Times of India, Economic Times, New Indian Express, DNA India

Advertisement

Advertisement