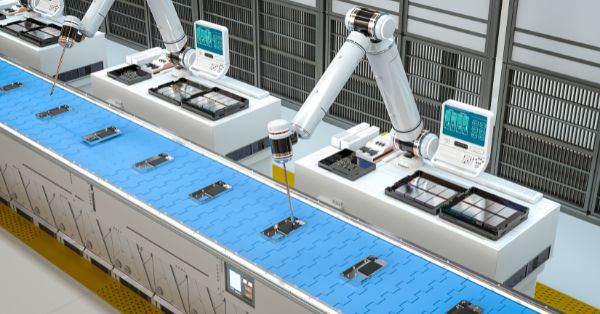

India has achieved a remarkable milestone: the local assembly of 99% of the smartphones being sold there, due to a decade of policy preference, domestic investment, and foreign partnerships. But the country now has to overcome an even tougher challenge: developing its electronics manufacturing ecosystem to the addition of semiconductors, displays, and high-value components.

1. From Assembly Hub to Manufacturing Powerhouse

-

India's mobile phone production rose from ₹18,900 crore in 2014–15 to ₹4.1 lakh crore in FY24, a staggering 2,000% rise.

-

Global popular brands like Apple and Samsung and Google now manufacture high-end models—like iPhone Pro and Pixel 8—within India.

-

Indian local brands and Chinese manufacturers like Xiaomi, Vivo, and Oppo too have set up massive-scale units.

2. The Next Frontier: Components & Value Addition

-

While India has dominance in final assembly, it still imports critical components like chipsets, displays, and cameras.

-

Government Production-Linked Incentive (PLI) schemes are now targeting semiconductors and display fabs, but the roll-out has been slow thus far.

-

Experts say India must build a robust supply chain, from design through fabrication and test facilities, to become a global electronics hub.

3. Policy Push & Global Opportunity

-

The government is also eyeing $500 billion of electronics production by 2030, with a strong focus on exports and high-technology manufacturing.

-

China+1 policies and geopolitical winds are pushing global firms to spread their supply chains, and India has a golden opportunity.

There still exist challenges in the offing in infrastructure, skilled manpower, and R&D expenditure.

Sources: Hindustan Times, IndBiz, PwC Report