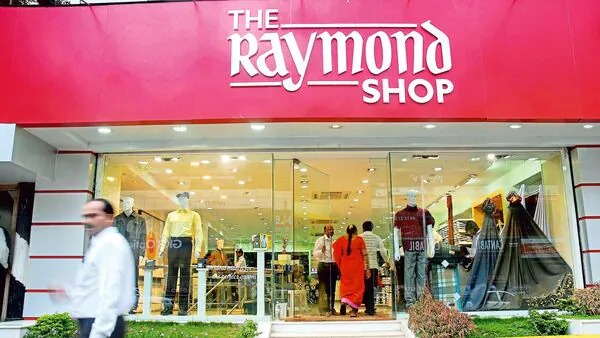

Image Source: Mint

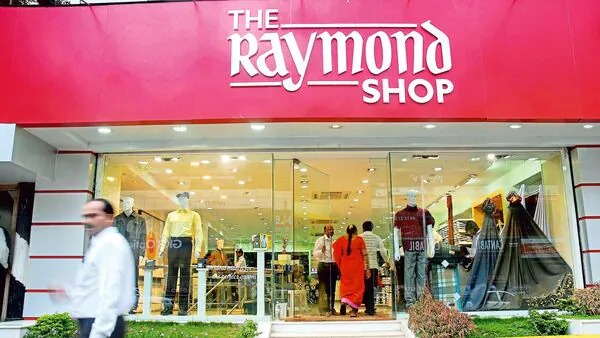

Image Source: Mint

In the wake of sweeping Goods and Services Tax (GST) reforms announced by the GST Council earlier this week, Raymond Group has confirmed that it will reduce prices of its apparel—particularly those priced above ₹2,500—in the coming months. The move is aimed at bringing more of its products under the lower 5% GST slab, thereby avoiding higher tax rates and passing on benefits to consumers.

Speaking to the media, Amit Agarwal, Group CFO of Raymond Ltd, said that the company is actively reworking its pricing strategy in response to the new GST structure. “Clothes priced above ₹2,500 are likely to be cut to fall below that threshold to avoid excess taxes,” Agarwal noted, adding that while the price reductions could have a short-term revenue impact, the company expects volume growth to offset the hit over time.

GST Council’s Big Reform

The announcement follows the 56th GST Council meeting held on September 3, 2025, where Finance Minister Nirmala Sitharaman unveiled a simplified two-slab GST structure—5% and 18%—for most goods and services, with a special 40% rate for luxury and sin goods.

One of the most significant changes for the textile and apparel sector was the decision to extend the 5% GST rate to apparel priced up to ₹2,500, up from the earlier ₹1,000 limit. Apparel priced above ₹2,500 will now attract the higher 18% GST rate. This shift is expected to benefit a large swathe of mid-market and premium brands that can adjust pricing to fit under the new threshold.

Impact on Raymond’s Portfolio

Raymond, a household name in India’s textile and apparel industry, operates across multiple price points—from affordable ready-to-wear lines to premium formalwear. The GST change creates both challenges and opportunities:

Premium apparel priced just above ₹2,500 could see price cuts to bring them into the 5% GST bracket, making them more attractive to price-sensitive consumers.

High-end luxury lines well above the threshold are unlikely to see major price changes, as repositioning them could dilute brand perception.

Mid-tier offerings stand to gain the most, as small price adjustments could significantly improve affordability and demand.

Agarwal acknowledged that the company will have to absorb some margin pressure in the short term but expressed confidence that increased sales volumes during the upcoming festive season will help balance the books.

Industry-Wide Ripple Effect

The GST rate cut is expected to have a broad impact on India’s apparel sector, which has been grappling with sluggish demand due to inflationary pressures and shifting consumer spending patterns. Industry analysts believe that the move could stimulate demand, particularly in the mass-premium segment, as brands recalibrate prices to take advantage of the lower tax rate.

Retailers like Trent, Aditya Birla Fashion & Retail, and Arvind Fashions are also expected to benefit from the reform, with many likely to follow Raymond’s lead in adjusting price tags. The timing—just weeks before the festive shopping season—could amplify the positive impact on sales.

Balancing Act: Revenue vs. Growth

While the GST cut is consumer-friendly, it does come with a potential revenue trade-off for apparel companies. Lower prices mean lower per-unit revenue, but if the move succeeds in driving higher volumes, the net effect could be neutral or even positive.

Agarwal struck an optimistic tone, saying, “We believe the slight reduction in prices will be more than compensated by increased footfalls and higher transaction volumes. The festive season will be a litmus test for this strategy.”

A Boost for the Textile Sector

The textile industry was one of the eight sectors identified by the government as a key beneficiary of the GST overhaul. By simplifying the tax structure and reducing rates on a wide range of goods, the Council aims to boost disposable income, improve compliance, and stimulate consumption.

For Raymond, the reforms align with its broader strategy of expanding market share in the mid-premium segment while maintaining its stronghold in premium and bespoke tailoring. The company is also expected to ramp up marketing campaigns to highlight the new, more affordable pricing on select lines.

Looking Ahead

The GST changes take effect from September 22, 2025, coinciding with the start of Navratri—a period that traditionally kicks off India’s peak festive shopping season. If Raymond’s pricing adjustments resonate with consumers, the company could see a strong finish to the calendar year, setting the tone for sustained growth in FY26.

The coming months will reveal whether the combination of tax relief, strategic pricing, and festive demand can deliver the volume boost that Raymond and the broader apparel industry are banking on.

Sources: Moneycontrol, ETCFO, ET Now

Advertisement

Advertisement