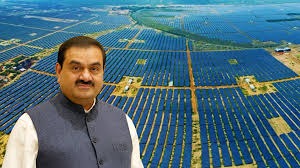

Adani Green Energy Ltd (AGEL), India’s largest renewable energy company, has reported a robust financial performance for the first quarter of FY26, reinforcing its position as a key player in the clean energy transition. The company posted a consolidated total income of Rs 40.06 billion and a net profit of Rs 7.13 billion, driven by higher operational capacity and improved efficiency across its solar, wind, and hybrid portfolios.

Financial Performance Snapshot

AGEL’s Q1 results reflect strong execution and operational discipline, with notable gains in profitability and revenue generation.

Key highlights from the earnings report:

- Consolidated total income stood at Rs 40.06 billion, up from Rs 31.2 billion in Q1 FY25

- Net profit surged to Rs 7.13 billion, marking a significant year-on-year increase

- EBITDA crossed Rs 10 billion, supported by higher capacity utilization and lower operating costs

- Net debt-to-equity ratio remained stable, indicating prudent financial management

The company’s profitability was aided by improved plant load factors (PLFs), better solar and wind yields, and favorable tariff realizations.

Operational Capacity and Efficiency Gains

AGEL continues to expand its renewable energy footprint, with operational capacity reaching 10,934 MW as of June 2025. This includes solar, wind, and hybrid installations across multiple states.

Operational insights:

- Solar capacity utilization factor (CUF) remained consistent at 24.5 percent

- Wind CUF improved by 420 basis points year-on-year to 29.4 percent

- Hybrid CUF rose by 520 basis points to 40.7 percent, reflecting optimal asset integration

- Total energy sales grew 48 percent year-on-year to 79.3 billion units

The company commissioned 2,418 MW of solar and 430 MW of wind capacity during the quarter, contributing to its top-line growth and reinforcing its execution capabilities.

Strategic Developments and Partnerships

AGEL is actively pursuing strategic partnerships and innovation-led growth to strengthen its leadership in the renewables sector.

Recent initiatives include:

- Signing a 20-year power purchase agreement (PPA) with Reliance Industries for 500 MW under the captive user policy

- Consolidation of term loan facilities worth Rs 19,700 crore into a long-term structure with an average maturity of eight years

- Operationalization of key transmission lines including Khavda-Bhuj and Warora-Kurnool, enhancing grid connectivity

- Expansion of its greenfield manufacturing and R&D capabilities to support next-gen solar modules and wind turbines

These moves align with AGEL’s long-term strategy to build an integrated renewable energy ecosystem and support India’s decarbonization goals.

Market Outlook and Sectoral Trends

India’s renewable energy sector is witnessing accelerated growth, supported by policy tailwinds, rising energy demand, and global climate commitments. AGEL is well-positioned to capitalize on these trends, given its scale, execution track record, and diversified portfolio.

Sectoral trends to watch:

- Increasing demand for hybrid and round-the-clock renewable energy solutions

- Government push for solar rooftop and distributed generation

- Rising interest from global investors in India’s green infrastructure

- Technological advancements in energy storage and grid integration

AGEL’s ability to deliver predictable cash flows and maintain high system availability makes it a preferred partner for utilities and industrial clients.

Final Takeaway

Adani Green Energy’s Q1 FY26 results underscore its operational strength and strategic clarity. With strong financials, expanding capacity, and a clear innovation roadmap, the company is poised to play a pivotal role in India’s energy transition. As the global shift toward renewables accelerates, AGEL’s integrated model and execution prowess will be key differentiators in a competitive landscape.

Sources: Adani Green Energy Ltd investor filings, Economic Times, Hindu BusinessLine, Moneycontrol, Business Standard, Reuters India, Financial Express, BloombergQuint, Mint