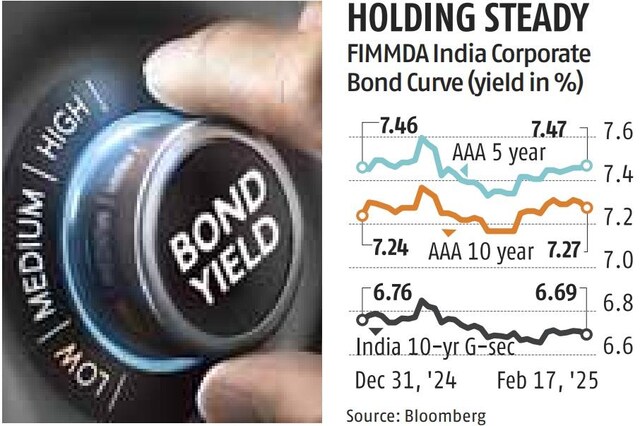

India’s 10-year government bond yield (IN067934G=CC) remained largely unchanged, settling at 6.2502%, compared to its previous close of 6.2531%. The stability comes amid investor anticipation of further Reserve Bank of India (RBI) rate cuts, alongside global market fluctuations.

Key Highlights:

-

Bond Yield Movement: The benchmark 10-year bond yield saw minimal change, reflecting steady investor sentiment.

-

RBI Rate Cut Expectations: Analysts predict that the RBI may reduce rates by 50 basis points, supporting liquidity and economic growth.

-

Market Liquidity Measures: The central bank is set to purchase ₹200 billion worth of bonds, injecting fresh liquidity into the system.

Global Factors:

-

US Federal Reserve’s stance on interest rates continues to influence emerging market bonds.

-

Foreign investor inflows into Indian bonds have remained stable, despite global uncertainties.

Stock Market Impact:

-

Sensex and Nifty showed mixed trends, with banking stocks reacting to bond yield stability.

-

Rupee movement remained range-bound, trading near 85.64 per US dollar.

Strategic Outlook:

India’s bond market remains resilient, with investors closely watching RBI’s next policy move. The stable yield suggests confidence in India’s economic fundamentals, despite global volatility.

Source: Investing.com, Ainvest, Trading Economics.