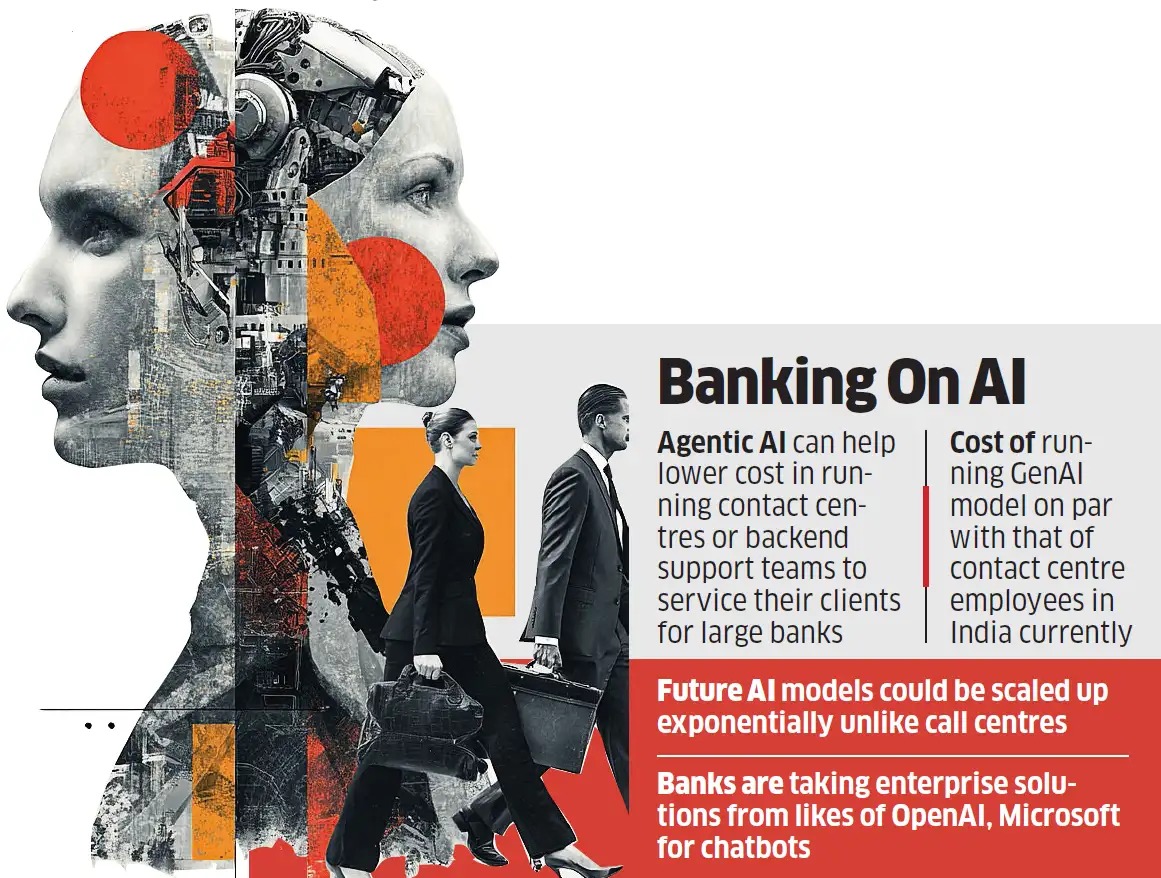

Tech Rush in BFSI BFSI business in India is undergoing a generative AI adoption boom, with the startups competing to provide customer service solutions that are designed to deliver scale, cost-effectiveness, and intelligent service. While the banks are struggling with legacy systems and regulatory issues, agentic AI models are becoming cost-effective substitutes for human-staffed contact centers.

Key Points

Bengaluru headquartered Gnani.ai says its conversational AI reduces the support cost by 40–50 percent and can handle customers five times more scale

Hyperface's GenAI model is already used in a fintech firm, assisting dormant app users and ready for credit card issuance assistance

Yellow.ai's bots, which have been trained for card issue queries and claims settlement, are prioritizing latency, accuracy, and conversational voice interaction

Deployment Trends

Arya.ai businesses, funded by Aurionpro, are embedding GenAI in banking stacks to answer questions in real-time

Bajaj Finance bought a 12 percent stake in Protectt.ai, reflecting increasing interest in mobile security with AI.

Voice bots are evolving from conventional ML models to adaptive learning GenAI agents possessing the capacity to solve issues in real time

Challenges & Compliance

Regulatory compliance remains a key challenge, with firms needing ISO 27001 and GDPR certifications

RBI will release more extensive guidelines as the deployment of AI gains momentum in BFSI

Issues of AI hallucination, mis-selling, and customer manipulation are fueling industry-wide calls for protection.

Outlook With 44 GenAI voice and speech technology startups—25 of which are funded—the sector is poised to be disrupted. With the cost decreasing and the functionality on the rise, startups are making large bets on transforming the way banks talk to customers.

Sources: Economic Times, Tearsheet, Finextra, Gartner, FutureMaster.net