One 97 Communications Ltd, the parent company of Paytm, has introduced an innovative financial product in collaboration with Suryoday Small Finance Bank, launching Paytm Postpaid—a credit line on the UPI platform that offers consumers the convenience of “spend now, pay next month.” This service is set to revolutionize digital payments by providing interest-free credit for up to 30 days, further strengthening Paytm’s commitment to enhancing consumer flexibility and empowering merchants.

Key Highlights Of The New Paytm Postpaid Offering

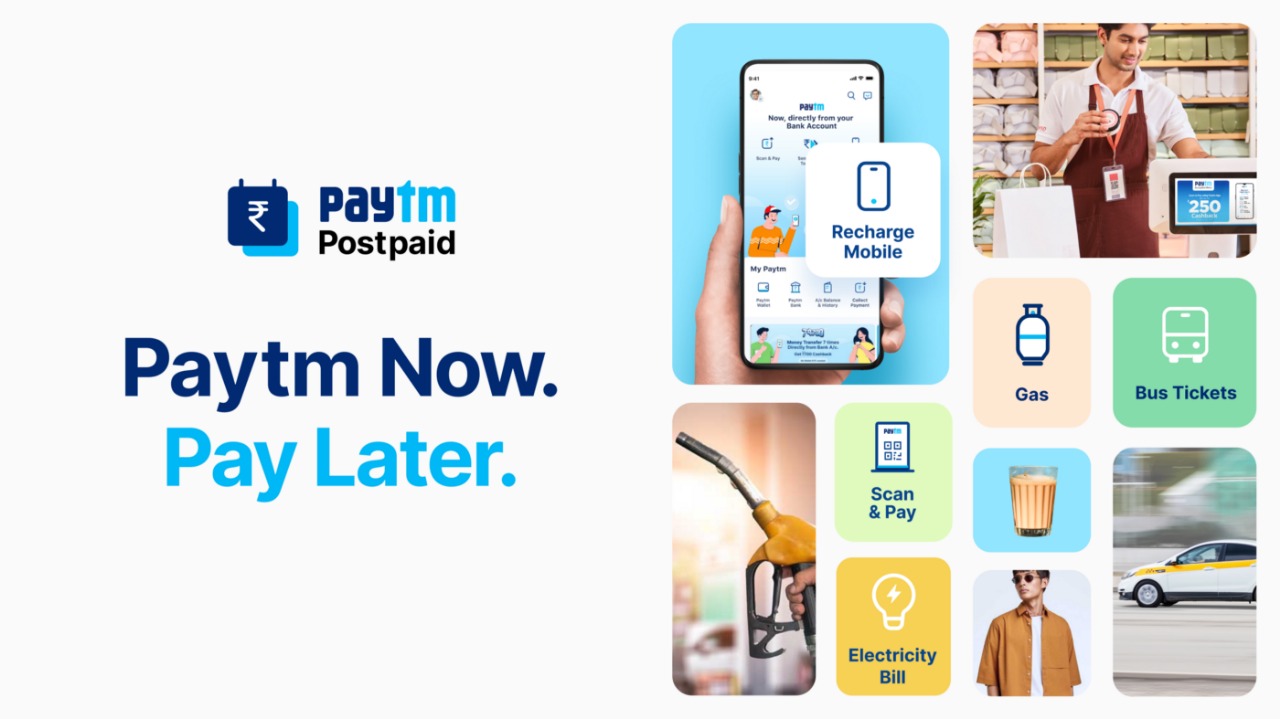

Paytm Postpaid allows users to make instant payments across any merchant UPI QR code or online platform using a short-term credit facility.

Consumers get up to 30 days of interest-free credit, with repayments scheduled for the following month, enabling better liquidity management without immediate cash outflows.

The credit line can be used for a wide range of transactions including bill payments, recharges, shopping on Paytm, and more, integrating seamlessly into daily financial activities.

Launched in partnership with Suryoday Small Finance Bank and powered by NPCI, the innovation leverages secure, real-time payment technology ensuring both consumer convenience and merchant assured settlement.

How The Postpaid Credit Line Works

Users can onboard by selecting the Paytm Postpaid option on the Paytm app, completing KYC verification, and selecting Suryoday Small Finance Bank to link their credit line with UPI. Once activated, consumers can:

Access pre-approved credit limits, typically up to Rs 60,000, tailored according to their spending behaviour.

Make payments at any merchant equipped with a UPI QR code or utilize the credit on online platforms.

Enjoy a completely digital, paperless process with instant approval and secure authentication via UPI PIN.

Benefits For Consumers And Merchants

Avijit Jain, COO of Lending at Paytm, emphasized how this launch addresses everyday financial needs, offering flexibility for families and individuals to manage expenses without disrupting cash flow. Vishal Singh, CIO at Suryoday Small Finance Bank, highlighted the partnership’s goal to expand access to responsible credit, ensuring a reliable and regulated backdrop for consumers.

Merchants similarly benefit from universal acceptance of the payment mode, immediate fund settlements, and harmonization with existing UPI payment flows—enhancing their business operations and customer experience.

Aligning With Digital India’s Payment Ecosystem

The Paytm Postpaid launch fits strategically into India’s larger objective of promoting a digital, cashless economy under the aegis of the National Payments Corporation of India (NPCI). It complements existing features like spend categorization, personalized UPI IDs, and detailed financial statements—all aimed at making payments smarter, faster, and more user-centric.

Market And Investor Perspective

From a market standpoint, analysts foresee this product potentially bolstering Paytm’s positioning as a comprehensive player in digital financial services. The credit line could attract more users to the Paytm ecosystem, fostering higher transaction volumes and deeper financial engagement.

How To Activate Paytm Postpaid Credit Line

Open the Paytm app and tap the Paytm Postpaid icon on the home screen.

Complete simple KYC and setup verification steps.

Link the credit line with your UPI account by choosing Suryoday Small Finance Bank.

Set up your UPI PIN and begin using the interest-free credit across all UPI acceptance points.

Closing Thoughts

Paytm’s launch of a postpaid credit line on UPI with Suryoday Small Finance Bank marks a significant advancement in providing consumers greater financial flexibility and convenience. This step reinforces Paytm’s commitment to innovate within India’s growing digital payments landscape, empowering individuals and businesses alike to transact efficiently while managing liquidity seamlessly.

Sources: Paytm Press Release, Business Upturn, Paytm Official Blog, NPCI Website