Union Cooperation Minister Amit Shah unveiled two digital platforms—Sahakar Digi Pay and Sahakar Digi Loan—for urban cooperative banks (UCBs), aiming to modernize operations and expand financial inclusion. He also set a national goal of establishing one UCB in every town, reinforcing the sector’s role in India’s cooperative development strategy.

Union Cooperation Minister Amit Shah unveiled two digital platforms—Sahakar Digi Pay and Sahakar Digi Loan—for urban cooperative banks (UCBs), aiming to modernize operations and expand financial inclusion. He also set a national goal of establishing one UCB in every town, reinforcing the sector’s role in India’s cooperative development strategy.

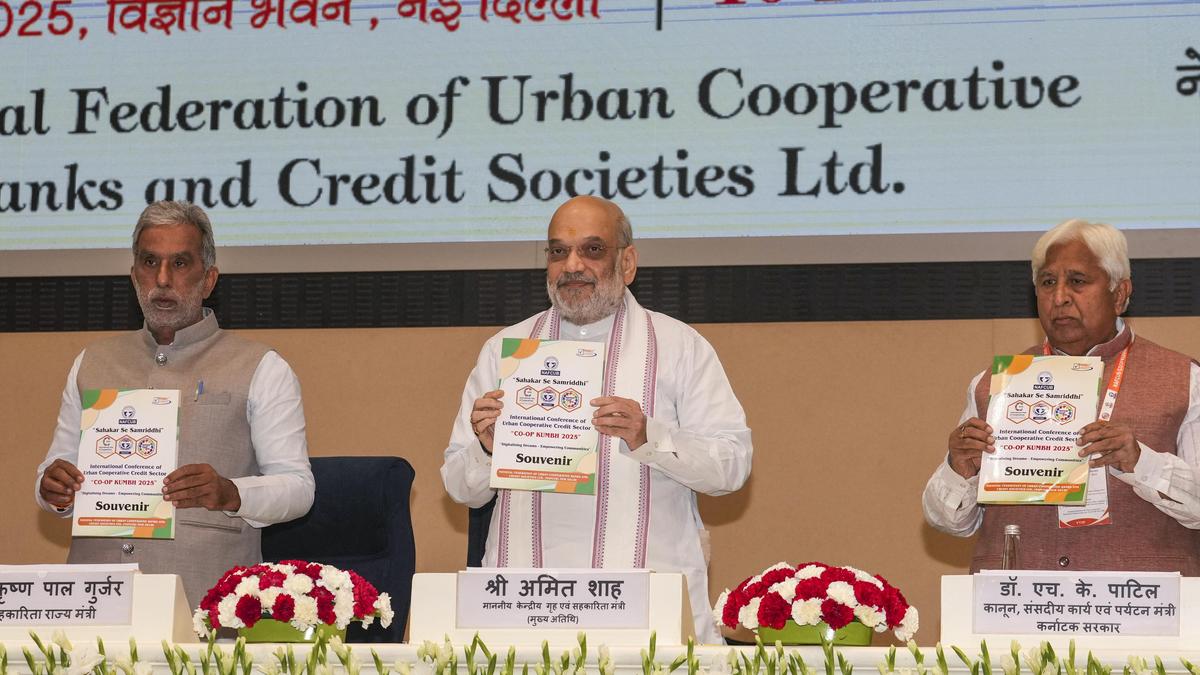

Union Cooperation Minister Amit Shah has launched two new digital applications—Sahakar Digi Pay and Sahakar Digi Loan—designed to strengthen the digital infrastructure of urban cooperative banks (UCBs). The announcement was made during the Co-op Kumbh 2025 event in New Delhi, attended by over 1,200 UCB representatives and sector leaders.

The initiative is part of the government’s broader push to modernize cooperative banking and ensure every town in India has access to a UCB.

Key highlights:

- Sahakar Digi Pay will enable secure, cashless transactions for UCB customers, improving digital banking access.

- Sahakar Digi Loan is designed to streamline loan approvals and disbursements, especially for small borrowers.

- Shah announced a national target to establish one urban cooperative bank in every town across India.

- The sector has shown improved asset quality, with NPAs declining from 2.8% to 0.6% over two years.

- The Reserve Bank of India was credited for its role in enabling reforms and supporting digital transformation.

- Shah emphasized the need for professional governance, financial discipline, and technological adoption in cooperative banks.

- The apps were launched in collaboration with NAFCUB, the apex body for UCBs, during the International Year of Cooperatives.

This digital push is expected to enhance the competitiveness of UCBs, expand their reach, and support inclusive financial growth across urban India.

Sources: Rediff Money, UNI India, WebIndia123, Indian Cooperative, Millennium Post, ET Government