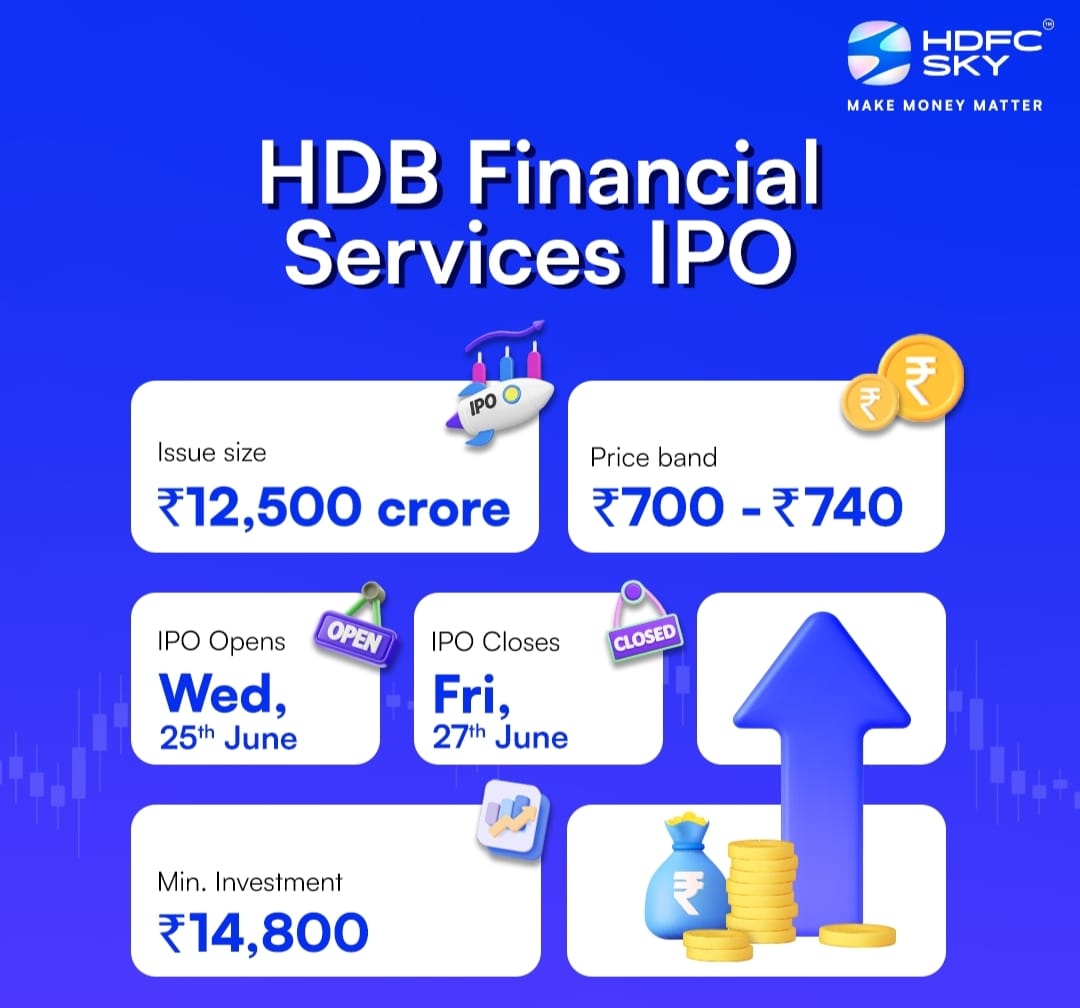

HDB Financial Services, the retail-focused NBFC backed by HDFC Bank, is set to launch its highly anticipated ₹12,500 crore IPO from June 25 to June 27, 2025, making it the largest public issue in the NBFC space this year. The IPO features a fresh issue of ₹2,500 crore and an offer for sale (OFS) of ₹10,000 crore by HDFC Bank, with shares priced between ₹700 and ₹740 each. The minimum retail application is for 20 shares (₹14,800 at the upper band), and the listing is scheduled for July 2, 2025, on BSE and NSE.

Key Highlights

-

IPO Dates: Subscription open from June 25 to June 27, 2025; listing on July 2.

-

Issue Structure: ₹2,500 crore fresh issue + ₹10,000 crore OFS by HDFC Bank.

-

Price Band: ₹700–₹740 per share; minimum lot size: 20 shares.

Application Process:

HDFC Sky’s One-Click IPO enables paperless, digital applications via mobile or web.

How to Apply:

-

Log in to HDFC Sky (app or web).

-

Go to "Indian Stocks" > "IPO" tab.

-

Select “HDB Financial Services IPO” and click “Apply Now.”

-

Enter lot quantity, price (or select cut-off), and category.

-

Enter your UPI ID, approve mandate in your UPI app, and submit.

Points to Note

-

Eligibility: Open to all HDFC Sky account holders with a demat account and UPI ID.

-

Special Quotas: Reserved portions for HDFC Bank shareholders and HDBFS employees.

-

Business Overview: HDB Financial operates across enterprise lending, asset finance, and consumer finance, with a vast branch network and a focus on underbanked customers.

-

Use of Proceeds: Fresh issue to boost Tier-I capital for future lending and regulatory compliance.

-

Promoter Stake: HDFC Bank’s holding will reduce from 94.3% to 74.19% post-issue.

-

GMP Buzz: Grey market premium signals strong listing expectations, with a premium of ₹83 as of June 20.

Why HDFC Sky?

-

HDFC Sky’s One-Click IPO feature streamlines the application, offering speed, transparency, and flexibility—no paperwork, instant UPI-based payments, and real-time tracking, all in one platform.

-

“The One-Click IPO tool removes the need for form-filling, enabling a paperless and time-efficient experience… Whether you are applying from a desktop or smartphone, the process remains consistent and user-friendly.”

With robust institutional backing, a diversified loan book, and a digital-first approach, HDB Financial’s IPO is poised to attract strong retail and institutional interest.

Source: The Tribune India, HDFC Sky, Economic Times, CNBC-TV18, The Week, Babushahi.