Follow WOWNEWS 24x7 on:

Updated: July 06, 2025 07:38

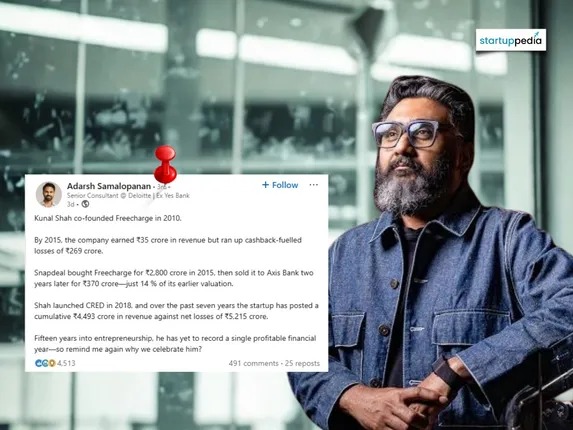

A LinkedIn post by Deloitte Senior Consultant Adarsh Samalopanan has ignited a withering controversy in India's startup ecosystem. The post contradicts the widespread sycophancy over CRED founder Kunal Shah, while his companies have recorded losses of over Rs 5,215 crore and never reported a single profitable year in 15 years of operations.

Debate Highlights

Samalopanan also mentioned that Shah's first failure, FreeCharge, made a revenue of Rs 35 crore by 2015 but had losses of Rs 269 crore before it was acquired by Snapdeal for Rs 2,800 crore.

Snapdeal subsequently offloaded FreeCharge to Axis Bank for Rs 370 crore, a valuation decline steep.

Shah's second venture, CRED, that he launched in 2018, has registered Rs 493 crore in total revenue in seven years and has posted net losses of Rs 5,215 crore.

The blog asked why the record continues to be greeted with wonder and media attention.

Public Reactions

The post caused a ripple of mixed reactions on the social media.

Shah's companies are justified by his supporters as having revolutionized India's consumer culture and digital finance.

The critics argue that money-losing startup glorification misshapes market expectations and investor responsibility.

Other users equated Shah's journey with other international tech billionaires who also delayed profitability for expansion and disruption.

Kunal Shah Connects

Shah accepted the criticism, saying that entrepreneurs who establish successful companies on their own also deserve their own share of the limelight.

He emphasized risk-taking in the AI world, with a focus on creating jobs rather than seeking jobs.

Shah emphasized that the success of startups is not always gauged by profit, but by how well they can transform markets and consumer habits.

Broader Reflections

The argument presents an even deeper question: Should profitability overrule valuation, innovation, and user adoption in determining startup success? It also sparks issues of valuations being overly optimistic, investor expectations, and the viability of venture-backed business models.

As India's startup ecosystem grows, the tension between vision and viability will be felt only more sharply.

Sources: Indian Startup News, Startuppedia, CNBC TV18, YourStory, Times of India, Forbes India