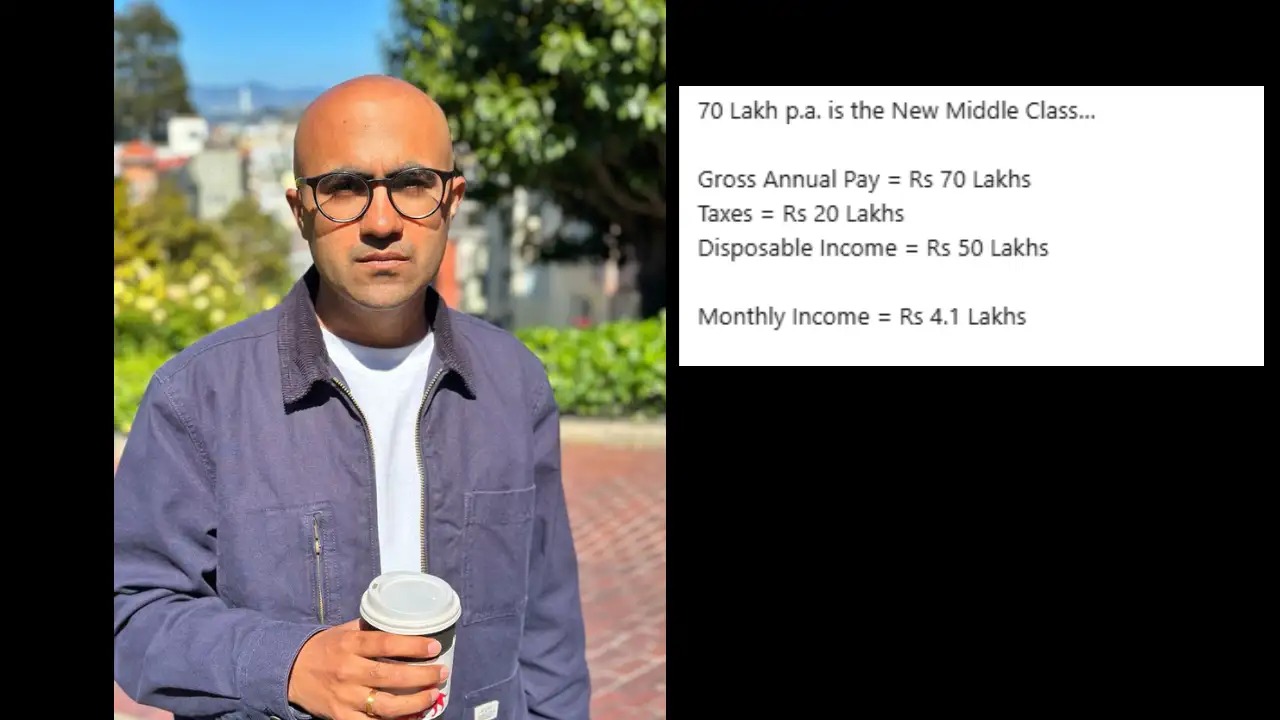

A viral LinkedIn post by investment banker Sarthak Ahuja has set off a national discussion: is ₹70 lakh a year still "middle class" in India's metro cities? For Ahuja, the answer is yes—and it's not as comforting as it sounds.

- ₹70 lakh pre-tax profits equal ₹50 lakh after tax deduction, or around ₹4.1 lakh a month.

- Principal fixed expenses:

-

- ₹1.7 lakh for a ₹2 crore home loan EMI

-

- ₹65,000 for a ₹20 lakh car loan

-

- ₹50,000 for overseas school charges

-

- ₹15,000 for the domestic staff

- That will be just ₹1 lakh remaining for fuel, healthcare, entertainment, groceries, and savings.

Ahuja calls this the "new middle class"—urban professionals who have good paper incomes but shallow pockets. He blames runaway inflation, very high real estate prices, and social media-driven aspirational consumption. In Mumbai and Gurugram, housing costs can be 30 times the annual salary, making home ownership a long-term burden.

Reiterating this warning, Marcellus Investment Managers' Saurabh Mukherjea recognizes that 5–10% of the middle-class households are now stuck in debt, with rising defaults on two-wheeler finance and credit cards. He cites a stark trend: financial savings are at a 50-year trough, non-mortgage debt is a peak in all countries.

Takeaway: Being financially independent does not mean high salaries. Ahuja's tip: "Think twice before signing up for a housing loan."

Sources: India Today, Business Today, Hindustan Times