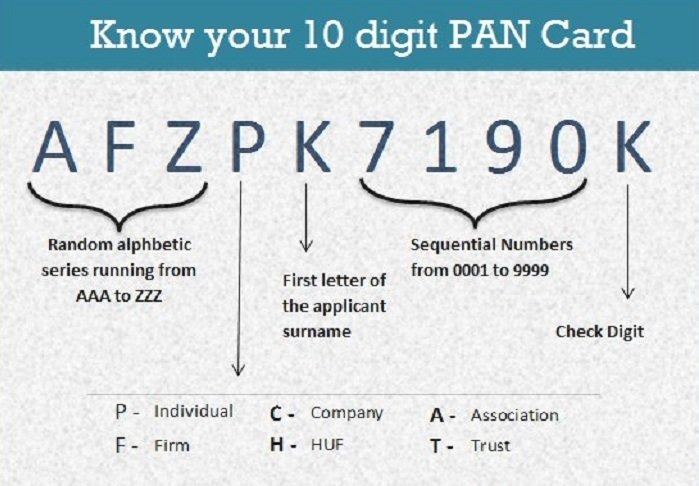

The PAN (Permanent Account Number) is a 10-character alphanumeric identifier issued by the Indian Income Tax Department. Each character has a specific significance, from the type of PAN holder to the initial of the surname, making the PAN both a unique identity code and a critical financial record.

The PAN is an essential document for Indians involved in financial transactions and tax filings. Understanding its 10-character code unlocks how the Income Tax Department uniquely identifies holders.

The first three letters (AAA to ZZZ) form an alphabetic series assigned randomly.

The fourth character denotes the holder’s type, such as:

P = Individual

C = Company

H = Hindu Undivided Family (HUF)

F = Firm

A = Association of Persons (AOP)

T = Trust

B = Body of Individuals (BOI)

G = Government

The fifth letter represents the first letter of the holder’s last name or entity’s name.

Characters six to nine are sequential numbers (0001–9999) ensuring uniqueness.

The tenth character is an alphabetic check digit for validation, generated through a mathematical formula.

This structured format helps prevent duplication and aids identity verification in banking, property transactions, and tax filings.

Key Highlights:

PAN is a 10-character alphanumeric code essential for Indian taxpayers.

First three letters: Random alphabetic series (AAA to ZZZ).

Fourth character: Holder category (e.g., P for individual, C for company).

Fifth character: Initial of holder’s surname or entity name.

Next four digits: Unique sequential numbers.

Last character: Checksum letter validating the PAN.

PAN serves as a unique identifier for taxation and financial tracking.

Sources: Income Tax Department India, Wikipedia, ClearTax, TaxGuru, Protean eGov Technologies