Yara South Asia is aiming for 2026 to launch innovative crop nutrition products in India, including a specialized potash solution for apple cultivation and new bio-stimulants, as prolonged regulatory approvals delay its commercialization pipeline. The company cites a four-to-five-year registration timeline in India, significantly slowing the introduction of sustainable farming solutions despite completed trials and strong market demand. Yara continues to advocate for faster regulatory reforms while expanding farmer education and green ammonia export partnerships.

Strategic Product Pipeline and Regulatory Challenges

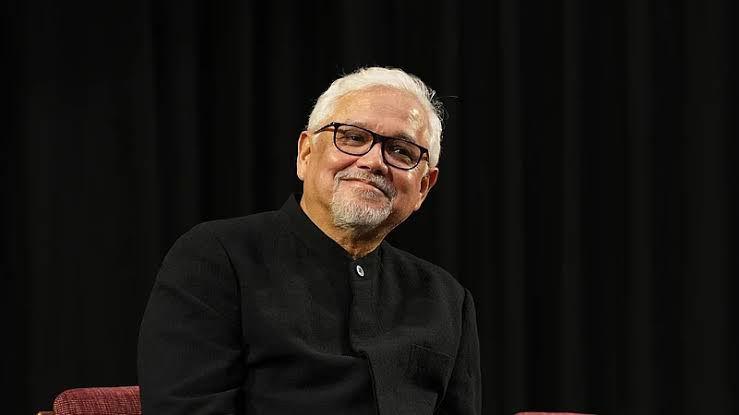

Yara South Asia is advancing a suite of next-generation agricultural products aimed at enhancing crop yield and sustainability, with a targeted 2026 launch window due to extended regulatory timelines. The company faces a four-to-five-year product registration process in India, despite having completed trials and submitted documentation to the Ministry of Agriculture. This delay contrasts sharply with a 2019 World Bank estimate of 97 days for fertilizer registration, highlighting systemic inefficiencies in the approval framework. Managing Director Sanjiv Kanwar emphasized that while swift action is needed against counterfeit products, the current system stifles innovation, particularly in the bio-stimulant segment, which is critical for sustainable agriculture.

Notable Updates on Product Development

A potash solution for fruit crops, especially apples, has completed trials and is awaiting approval; it is expected to improve fruit color, size, and shelf life by enhancing potassium uptake and sugar transport.

The product could be launched within three months of regulatory clearance and aligns with Yara’s global apple nutrition programs that optimize yield and quality.

Yara is also trialing five bio-stimulants from its UK facilities across Indian agro-climatic zones, building on existing partnerships with local innovators like C6 and Bio Prime.

The company advocates for a label-claim-based regulatory system listing minimum nutrients and contaminants to accelerate market access for new formulations.

Major Takeaways on Business Strategy

Yara South Asia is prioritizing organic growth over acquisitions, integrating its Babrala urea plant output with specialty fertilizers as “force multipliers” to boost productivity.

The company conducts 30,000–50,000 farmer meetings annually and reaches 1 million active users via its Farm Care app, delivering hyper-local weather and crop guidance.

Yara’s balanced crop programs, combining subsidized urea and DAP with specialty products, have delivered 15–20% yield increases where implemented.

Expansion of Yara’s Yorkshire plant will increase micronutrient supply to India, reducing import dependency and strengthening local market resilience.

Important Points on Sustainability and Partnerships

Yara Clean Ammonia is positioning India as a green ammonia export hub, signing MOUs with Indian producers like AM Green to access global markets.

A term sheet with AM Green covers long-term supply of up to 50% of renewable ammonia from its Kakinada facility, compliant with EU RFNBO standards, starting in 2027.

The company is collaborating with ICAR, WorldVeg, and the UP Sugar Research Institute on bio-stimulant and crop-specific trials to validate product efficacy.

Yara’s strategy emphasizes a blended approach combining mineral fertilizers with bio-stimulants and organics to maximize farmer benefits and environmental sustainability.

Sources: PTI, The Week, Moneycontrol, Yara India, AM Green, Carbon Credits