Image Source : MSN

Image Source : MSN

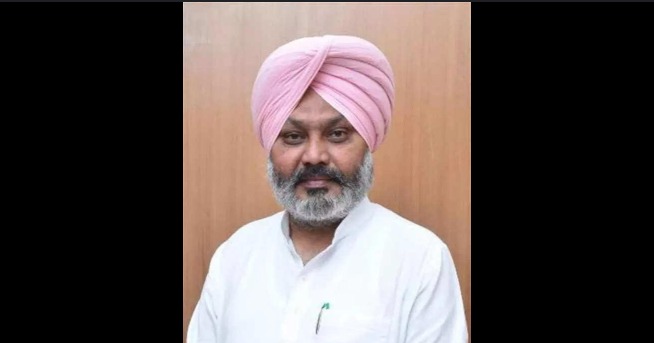

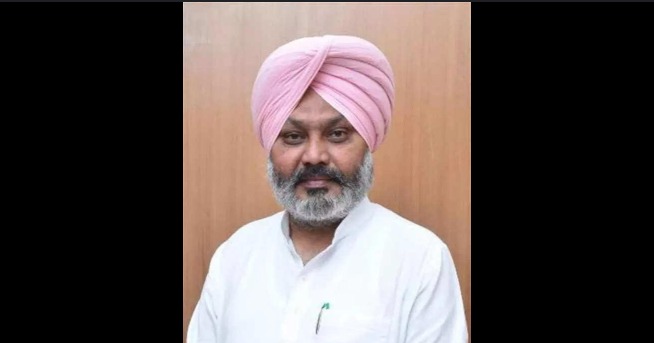

Punjab Finance Minister Harpal Singh Cheema has defended the state’s decision to borrow Rs 8,500 crore in Q2 FY26, asserting that the move is both necessary and fiscally responsible. The borrowing, spread across July to September, is aimed at meeting legacy debt redemption obligations while supporting long-term investments in infrastructure and governance.

Here’s a detailed breakdown of the borrowing strategy and its broader fiscal context.

Breakdown of Borrowing Plan and Purpose

• The state will raise Rs 2,000 crore in July, Rs 3,000 crore in August, and Rs 3,500 crore in September

• Funds will be used to repay over Rs 3,500 crore in legacy debt inherited from previous SAD-BJP and Congress governments

• The borrowing is part of a full-year target of Rs 34,201 crore and remains within Reserve Bank of India’s sanctioned limits

• Cheema emphasized that the borrowing is not reckless but a structured response to past liabilities and future needs

Fiscal Management and Revenue Performance

• Punjab has already borrowed Rs 6,241.92 crore in April and May, bringing total borrowings to Rs 14,741.92 crore so far in FY26

• The state has invested Rs 1,000 crore each in the Guarantee Redemption Fund and Consolidated Sinking Fund, with the latter now exceeding Rs 10,000 crore

• June 2025 saw a record 44.44 percent year-on-year increase in net GST collections, reaching Rs 2,379.90 crore

• Q1 FY26 GST collections stood at Rs 6,830.40 crore, up 27.01 percent from the previous year

Response to Opposition Criticism

• Cheema dismissed opposition concerns as short-sighted, arguing that borrowing is a standard fiscal tool used globally

• He contrasted the current government’s approach with previous regimes that relied heavily on central compensation and lacked long-term planning

• The minister highlighted improved tax compliance and enforcement as key drivers of revenue growth

Debt Obligations and Future Outlook

• Punjab faces interest payments of Rs 25,000 crore and principal repayments of Rs 18,200 crore in FY26

• Despite projections of total debt crossing Rs 4 lakh crore by March 2026, Cheema maintained that the state’s fiscal health is improving

• The borrowing plan is expected to support infrastructure upgrades, welfare schemes, and economic development without compromising financial discipline

As Punjab navigates its fiscal roadmap, the Rs 8,500 crore borrowing plan reflects a balancing act—where legacy debt meets proactive governance, and financial prudence underpins developmental ambition.

Sources: MSN News, Times of India, Daily Pioneer, ABP News

Advertisement

Advertisement