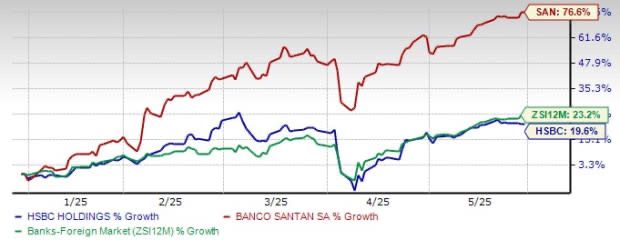

Image Source: Yahoo Finance

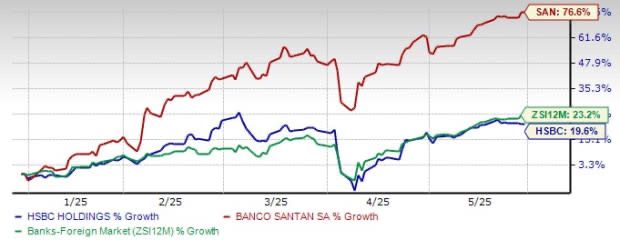

Image Source: Yahoo Finance

Investors looking for exposure to global banking powerhouses have two European heavyweights to consider: HSBC Holdings plc (HSBC) and Banco Santander S.A. (SAN). But which one presents the stronger opportunity in today’s volatile market?

HSBC continues to push its Asia-focused strategy, aiming to become a dominant force in wealth management. The bank is expanding its retail footprint in China and India, acquiring Citigroup’s wealth portfolio, and investing in digital transformation. Meanwhile, HSBC is retreating from some Western markets, exiting the U.S. and Canada, as it seeks to streamline operations and cut costs through a $1.5 billion restructuring plan.

Santander, on the other hand, remains focused on Europe and the Americas, leveraging its strong retail banking presence and digital innovation. The Spanish lender is betting big on expanding business lending while accelerating transformation through its tech-driven initiatives.

While HSBC’s strategy prioritizes high-net-worth clients in Asia, Santander is banking on broader consumer access and digital expansion. With interest rates and economic challenges looming, investors must weigh HSBC’s regional bet against Santander’s diversified approach.

Which bank stands out in 2025? HSBC’s earnings growth will depend on Asia’s resilience, while Santander’s transformation plan could boost profits over time.

Source: Yahoo Finance

Advertisement

Advertisement