Follow WOWNEWS 24x7 on:

India is rapidly emerging as a central pillar in the China+1 strategy adopted by global automotive original equipment manufacturers (OEMs), according to a joint report by EY and Parthenon. As companies seek to diversify their supply chains and reduce overdependence on China, India’s cost competitiveness, policy support, and manufacturing capabilities are positioning it as a preferred sourcing and production hub for auto components.

The shift is being driven by geopolitical tensions, supply chain disruptions, and rising costs in China, prompting global automakers to explore alternative destinations. India’s rise is further catalyzed by the Production-Linked Incentive (PLI) scheme and a robust export ecosystem, making it a strategic choice for long-term investment.

Key Highlights From The EY-Parthenon Report

- India is now a key sourcing destination for global auto OEMs under the China+1 strategy

- Auto component exports from India have reached USD 61.8 billion

- The PLI scheme offers 8 to 18 percent sales-linked incentives for advanced and electric vehicle components

- India’s low manufacturing costs and political stability are attracting global supply chain realignment

- OEMs are investing in R&D and technology upgrades to leverage India’s potential

Why Global OEMs Are Turning To India

1. Cost Advantage and Scale

- India offers significantly lower manufacturing costs compared to China and other Asian peers

- A large, skilled workforce and expanding infrastructure support high-volume production

2. Policy Support and Incentives

- The government’s PLI scheme for the auto sector has a financial outlay of USD 3 billion

- Incentives are targeted at advanced technologies, EV components, and exports

- Ease of doing business and regulatory reforms have improved investor confidence

3. Export Momentum

- India’s auto component exports have surged, with strong demand from the US, EU, and Latin America

- Key export categories include drive and transmission systems, steering assemblies, and engine components

- Multinational component makers are expanding capacity in India to meet global demand

4. Technology Leapfrogging

- Industry leaders emphasize the need for innovation rather than imitation

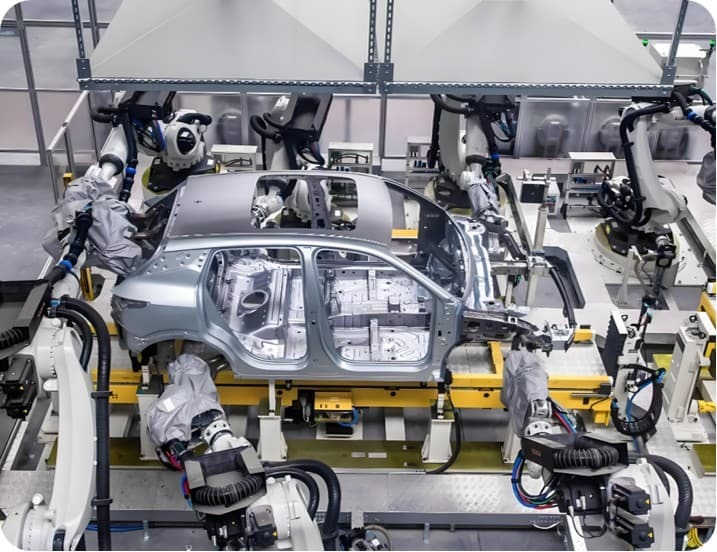

- Investments in automation, Industry 4.0, and smart manufacturing are reshaping India’s auto-tech landscape

- Companies are developing software-defined vehicles and AI-powered diagnostics to stay ahead

Strategic Implications For India’s Auto Sector

- India is transitioning from a domestic manufacturing base to a global export hub

- OEMs are setting up International Purchase Offices (IPOs) to streamline sourcing from India

- The country’s auto-tech ecosystem is attracting investments in semiconductors, EV platforms, and fleet intelligence

- India’s economic growth and rising income levels are creating a dual advantage: strong domestic demand and export capability

Expert Perspectives

Amitabh Kant, former CEO of NITI Aayog, emphasized the need for India to leapfrog in technology rather than replicate China’s model. He noted that long-term success will depend on innovation, quality, and global competitiveness.

Chief Economic Adviser Anantha Nageswaran highlighted India’s political stability, dynamic workforce, and expanding market as key factors making it an ideal destination for manufacturing investments.

Looking Ahead

India’s emergence as a key pillar in the China+1 strategy is not just a short-term trend—it reflects a structural shift in global supply chains. With strong policy backing, technological advancement, and export momentum, India is poised to become a global leader in auto component manufacturing. For OEMs seeking resilience, scalability, and innovation, India is increasingly the destination of choice.

Sources: Economic Times, MSN India.