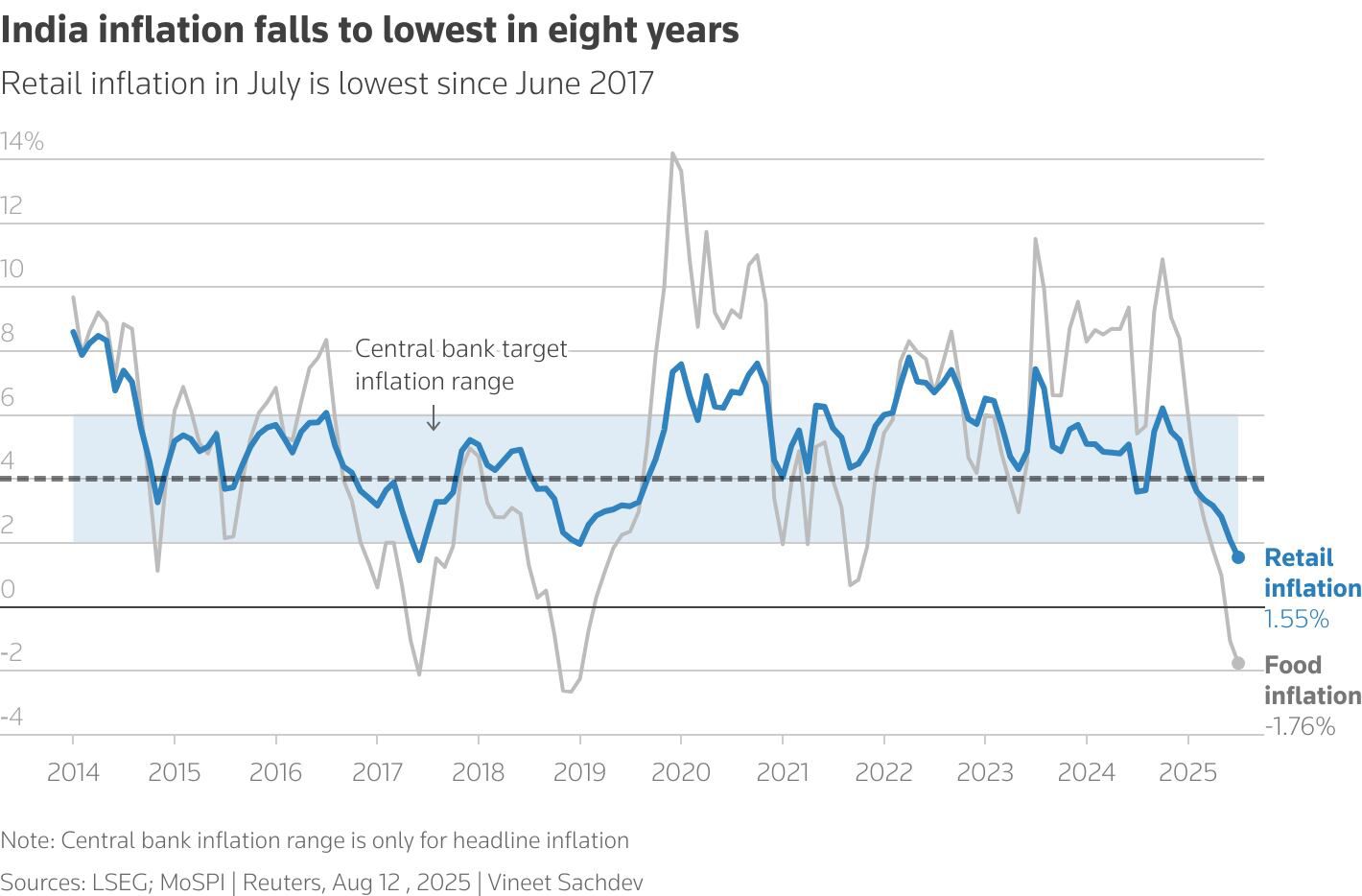

India’s retail inflation has dropped to an eight-year low of 1.55% in July 2025, falling below the Reserve Bank of India’s mandated tolerance band of 2% to 6% for the first time since January 2019. This sharp moderation, driven by cooling food prices and a favourable base effect, marks the ninth consecutive month of disinflation and offers the RBI greater flexibility in its monetary policy stance amid global economic uncertainty.

Key Highlights

Consumer Price Index (CPI) inflation eased to 1.55% in July, down from 2.10% in June.

Food inflation turned negative at –1.76%, the lowest since January 2019.

Core inflation (excluding food and fuel) remained steady at 4.1%, indicating stable domestic demand.

Wholesale Price Index (WPI) inflation also declined to –0.30% in July.

RBI retained the repo rate at 5.5%, maintaining a neutral stance.

Drivers Behind the Decline

Cooling Food Prices

Prices of pulses, cereals, and vegetables saw significant declines.

Despite seasonal upticks in onions and tomatoes, overall food inflation contracted year-on-year.

A strong spring harvest and healthy supply chains contributed to the moderation.

Favourable Base Effect

July 2024 had relatively high inflation, amplifying the year-on-year drop.

This statistical effect played a key role in pushing headline inflation below the RBI’s lower threshold.

Rural vs Urban Trends

Rural inflation stood at 1.18%, while urban inflation was slightly higher at 2.05%.

State-level disparities were notable: Kerala recorded the highest CPI inflation at 8.89%, while Assam saw –0.61%, the lowest.

RBI’s Policy Response

The RBI’s Monetary Policy Committee (MPC), led by Governor Sanjay Malhotra, opted to hold the repo rate steady at 5.5% during its August meeting. The central bank cited a “benign inflation outlook” and emphasized the need to monitor global risks before considering further easing.

The RBI revised its FY26 inflation forecast downward to 3.1%, from 3.7% earlier.

The stance remains neutral, with a wait-and-watch approach amid tariff uncertainties and rupee volatility.

Analysts expect any further rate cuts to be considered only in October or December, depending on festive demand and agricultural output.

Implications for the Economy

Room for Monetary Support

With inflation below the lower band, the RBI has more leeway to support growth if needed.

However, economists caution against aggressive easing, given the potential for inflation to rebound in Q4 FY26.

Impact on Borrowing and Lending

Banks have already lowered lending rates in response to previous repo cuts.

Lower inflation may further reduce borrowing costs, boosting consumption and investment.

Global Context

The drop in inflation comes amid rising U.S. tariffs on Indian goods and broader global uncertainty.

RBI officials stated that unless retaliatory tariffs are imposed, the impact on inflation will remain limited.

Expert Views

Aditi Nayar (ICRA): The decline is largely due to base effects and softening food prices; inflation may rise again in early 2026.

Paras Jasrai (India Ratings): Core inflation remains firm, suggesting underlying demand is intact.

Sakshi Gupta (HDFC Bank): The disinflationary trend is expected to continue, supported by healthy supply conditions.

Outlook

While the July inflation print is encouraging, it may be temporary. Analysts expect inflation to edge up in the coming quarters, potentially breaching the 4% mark again. For now, the RBI has gained valuable policy space to balance growth and stability, but vigilance will be key as external risks evolve.

Sources: Reuters, News18