Reliance Industries soared to a fresh 52-week peak, driven by JPMorgan’s strong ‘overweight’ rating and a bullish 2026 earnings outlook. The stock’s attractive valuations, refining margin recovery, and upcoming catalysts such as Jio IPO, telecom tariff hikes, and new energy business milestones underpin JPMorgan’s 11% upside target.

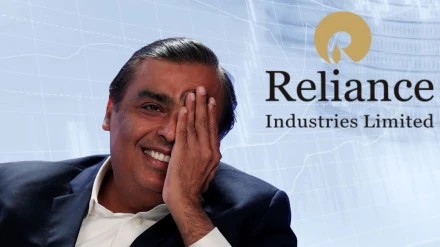

Mukesh Ambani-led Reliance Industries Limited (RIL) touched a new 52-week high of around Rs 1,559 on Tuesday, extending its impressive year-to-date gains to 27%. This surge follows a reaffirmation by global brokerage JPMorgan of its ‘overweight’ rating on the stock, coupled with a price target of Rs 1,727 — implying nearly 11% upside from current levels.

JPMorgan’s optimism reflects a strong earnings outlook for FY26, underpinned by several key factors. Firstly, the earnings drag from weak refining and petrochemical margins through FY24-25 has largely dissipated as refining margins have shown a robust rebound. Secondly, the brokerage highlighted multiple forthcoming growth triggers: the much-anticipated IPO of Reliance Jio, potential telecom tariff hikes, commissioning milestones in the new energy business including battery manufacturing, and stable retail growth.

Additionally, Reliance’s diversified crude sourcing and scale advantages position it well amidst global geopolitical uncertainties. Analysts from Motilal Oswal and UBS also maintain positive ratings, citing improvements in oil-to-chemicals earnings and new energy business expansion, including a battery giga factory planned for early 2026.

Despite its gains, JPMorgan pointed out that RIL’s valuations remain attractive relative to peers such as D-Mart and Bharti Airtel, with a holding company discount of roughly 15%. This valuation gap combined with multiple growth catalysts supports the strong upside potential for the stock moving forward.

Important points:

-

RIL hit a 52-week high near Rs 1,559, gaining 27% YTD.

-

JPMorgan maintains ‘overweight’ rating with Rs 1,727 target price (11% upside).

-

Refining margin recovery ends prior earnings pressure.

-

Key upcoming triggers: Jio IPO, telecom tariff hikes, new energy milestones.

-

Motilal Oswal and UBS also bullish on RIL’s energy and refining segments.

-

Holding company discount narrows, yet stock remains undervalued relative to peers.

-

RIL’s integrated ecosystem in solar and battery tech offers competitive edge.

Sources: NSE Circular, JPMorgan, Motilal Oswal, UBS, Reuters, NSE data reports.