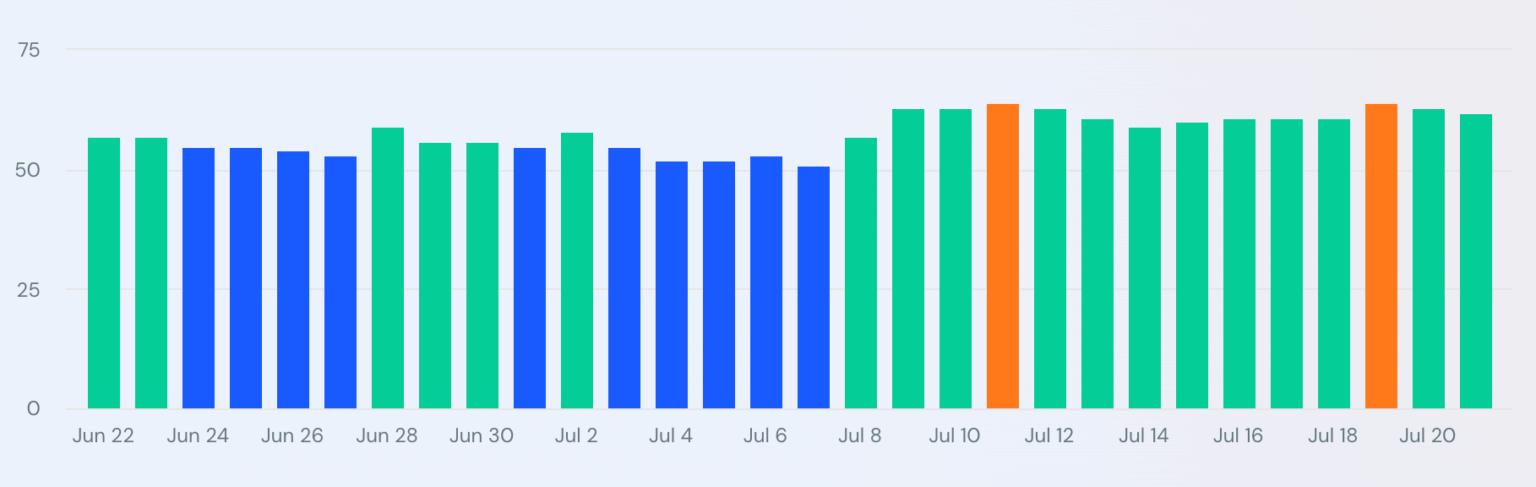

Image Source : Trendlyne.com

Image Source : Trendlyne.com

Indian Railway Finance Corporation Ltd (IRFC) has reported a robust financial performance for the June 2025 quarter, with total revenue from operations reaching ₹69.15 billion and net profit climbing to ₹17.46 billion. The results underscore IRFC’s pivotal role in financing Indian Railways’ infrastructure and rolling stock.

Key Highlights:

- Revenue rose 2.1% year-on-year, driven by consistent lease rentals and interest income

- Net profit increased 10.3% sequentially, reflecting lower finance costs and stable asset quality

- Operating margin remained strong, supported by minimal provisioning and efficient cost control

- IRFC’s asset base continues to expand, with fresh disbursements to NTPC and PVUNL during the quarter

- The company maintained its AAA credit rating and zero non-performing assets

Strategic Outlook:

IRFC is expected to deepen its presence in renewable energy and logistics financing, aligning with national infrastructure goals and railway modernization.

Sources: Economic Times, Moneycontrol, IRFC Exchange Filings.

Advertisement

Advertisement