Amazon stock has faced a turbulent 2025, hammered by sweeping U.S. tariffs on Chinese imports that sent shares tumbling 14% from their highs and rattled investor confidence. Yet, despite this storm, analysts and market watchers see Amazon as the most likely contender to become Wall Street’s first $5 trillion company-potentially outpacing even Nvidia and Microsoft.

Key Highlights:

-

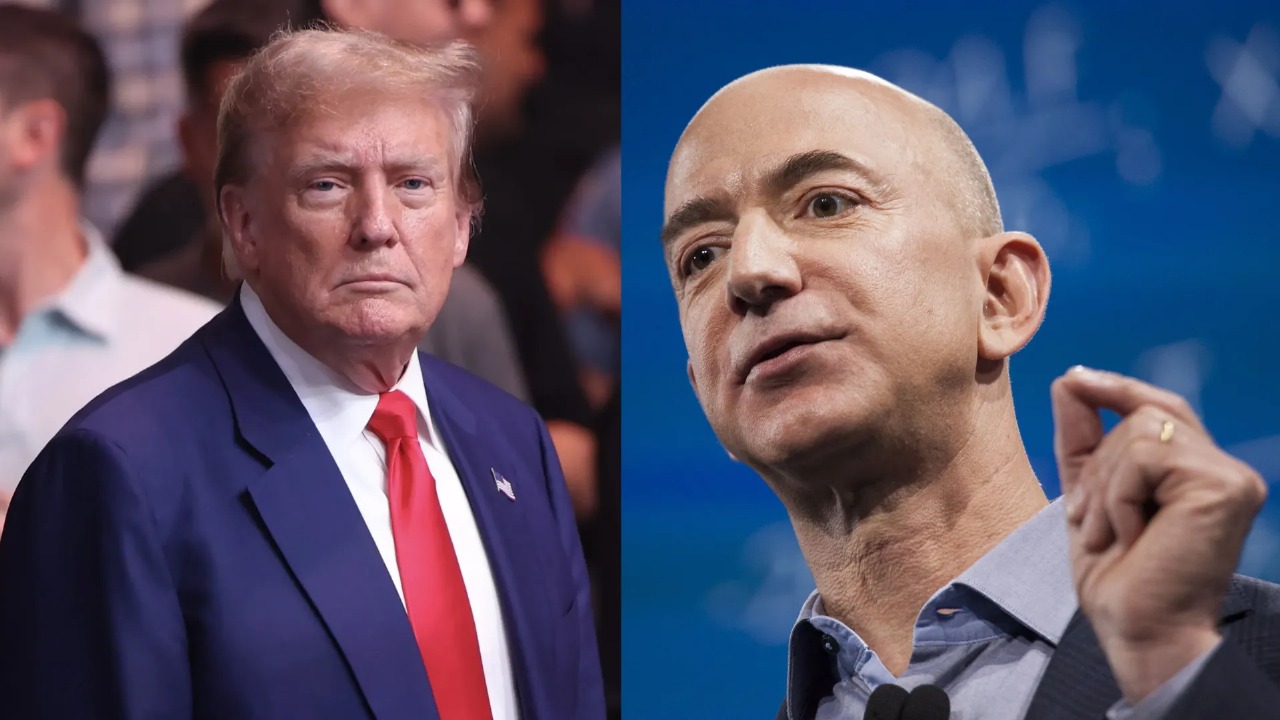

Tariff Turbulence: President Trump’s aggressive tariff hikes, with rates on Chinese goods soaring as high as 145% before a recent temporary rollback, have squeezed Amazon’s core e-commerce business. Many third-party sellers source products from China, forcing price hikes, inventory stockpiling, and operational headaches. The company’s market cap now sits at $2.2 trillion, down from recent peaks as investors fret over rising costs and supply chain disruptions.

-

Short-Term Pain, Long-Term Gain: Despite these headwinds, Amazon’s fundamentals remain strong. The company continues to deliver double-digit revenue growth, with a recent 10% year-over-year jump. Analysts project that Amazon could reach $1 trillion in annual revenue by 2030, driven by relentless expansion in both e-commerce and cloud computing.

-

AWS and AI Powerhouse: Amazon Web Services (AWS) is the crown jewel, boasting robust margins and capturing a growing share of the global AI and cloud market. AWS’s enterprise-focused AI offerings and data center dominance are expected to fuel outsized profit growth, even as rivals like Microsoft and Google chase the same prize.

-

Logistics and Advertising Moats: Amazon’s massive investments in logistics and last-mile delivery are lowering costs and speeding up shipping, deepening its competitive moat. Meanwhile, its advertising business is surging, adding a high-margin revenue stream that’s still in early innings.

-

Valuation Advantage: Trading at a forward P/E of 29.5-below many tech peers-Amazon is seen as undervalued given its growth trajectory and diversified profit engines. If free cash flow hits projected targets, a $4–$5 trillion valuation is within reach by the end of the decade.

The Bottom Line:

Tariffs have bruised Amazon in the short run, but its unmatched scale, cloud leadership, and strategic bets on AI and logistics position it to leapfrog competitors and potentially become the first $5 trillion titan on Wall Street.

Source: Yahoo Finance, AInvest, The Wall Street Journal