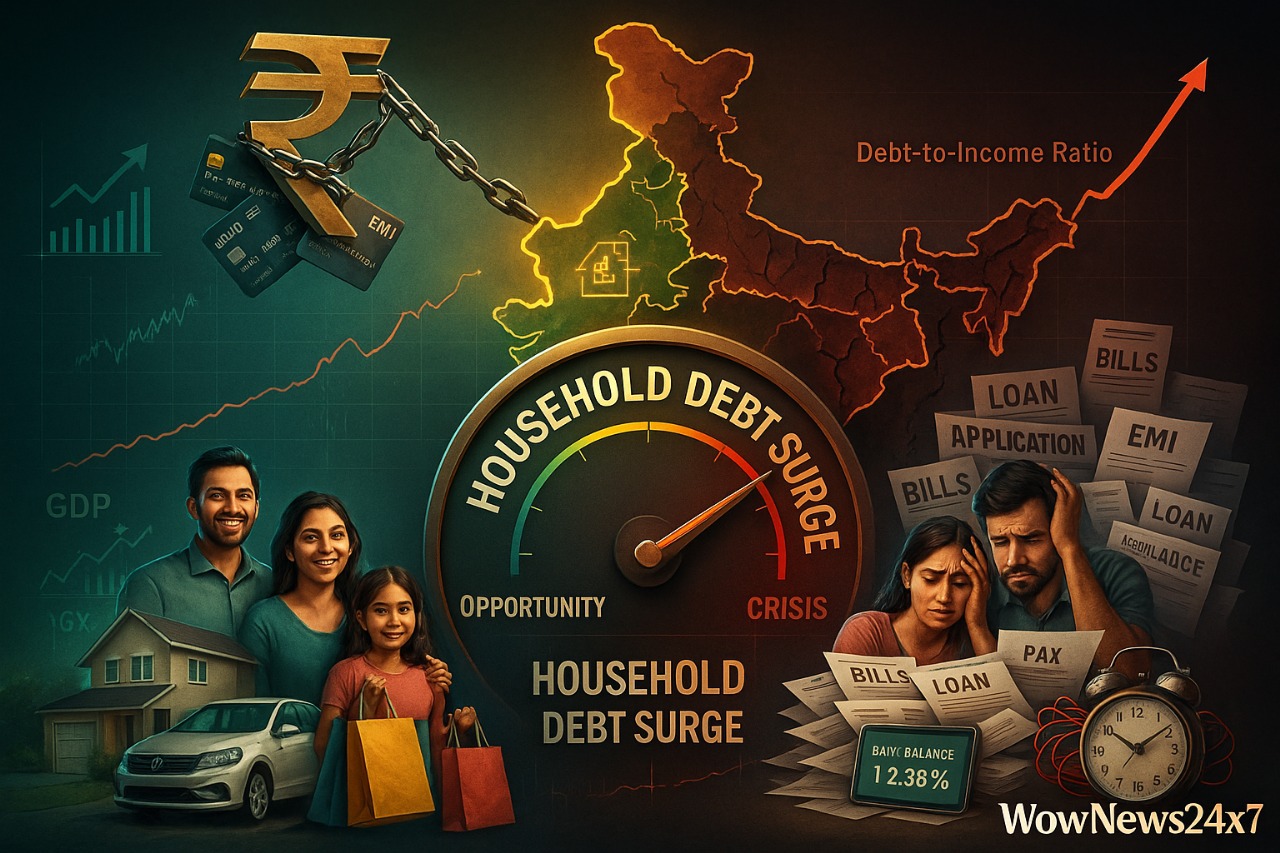

Short-Term Growth, Long-Term Risk: Increased household debt can temporarily spur economic growth. When households take loans to purchase homes, automobiles, or consumer durable items, it increases spending, generates employment, and raises GDP. This growth is usually unsustainable, though. As the level of debt increases, households increasingly spend more of their income in loan repayments, ultimately reducing their capacity to spend on other items and services. This has been the trend across the world, in India, the US, and China too.

India's Debt Binge: In early 2025, India's household debt hit 23.9% of GDP, with unsecured personal loans among low-income households rising sharply. Worse still, roughly a third of new loans are spent on necessities such as food, medicine, and school fees—nothing for asset building. At the same time, household savings have fallen to a 50-year trough, with families highly vulnerable to economic shocks and recession.

Global Trends and Policy Response: The US experienced household debt reach $18.2 trillion in Q1 2025, with delinquencies in mortgages and student loans increasing. South Korea is tightening lending standards due to a steady increase in household borrowing, adopting stricter debt-service-ratio (DSR) guidelines to limit the amount households can borrow relative to their income.

Risk of Over-Leverage: When debt in the household increases more rapidly than income, the potential for defaults and financial instability increases. Increasing debt service costs decrease disposable income, necessitating reductions in spending and making loan defaults more likely, particularly in low-income households. Defaults lead to a cycle of dysfunction: when defaults increase, banks become more stringent in their lending, further dampening consumption and economic activity.

Long-term Economic Drag: Various studies, including IMF and BIS analyses, indicate that although household debt enhances consumption and growth in the short term, it slows long-term growth. An increase of 1 percentage point in household debt-to-GDP can reduce long-term GDP growth by 0.1 percentage point. Once debt levels exceed specific thresholds (approximately 60% of GDP for consumption, 80% for GDP growth), adverse impacts worsen.

Financial Vulnerability and Inequality: The debt boom is particularly concerning for lower- and middle-class families, who increasingly turn to credit for necessities. This increases financial risk and expanding inequality. In India, the meltdown of real wage growth and weak social security nets have placed several families one shock away from bankruptcy.

Banking Sector Impact: Increasing defaults and delinquencies, particularly in unsecured loans and student loans, can undermine bank profitability and stability. As in the US and India, banks are increasingly writing off bad loans, and regulators are looking for evidence of stress in retail credit portfolios.

Policy Solutions and the Road Ahead:

Experts suggest a combination of short- and long-term interventions:

-

Tighter Credit Standards: Improved lending standards and improved risk profiling to avoid over-borrowing, particularly for unsecured credit.

-

Financial Literacy: Educating families on prudent borrowing and debt management.

-

Income Growth: Policies to increase real wages, generate employment, and discourage the use of credit for consumption.

-

Social Safety Nets: Widening income protection and jobs protection to buffer poor families.

-

Redirecting Credit: Promoting loans for productive uses—education, skill upgradation, and entrepreneurship—over consumption.

Conclusion: Increasing household debt is a double-edged sword. It can spur economic activity in the near term, but when debt growth, particularly for consumption, goes unchecked, it can lay the seeds of future crises, hinder long-term growth, and widen inequality. Policymakers, banks, and consumers need to work together to make sure that credit supports sustainable prosperity, and not financial vulnerability.

Source: Scroll.in, Financial Express, Yonhap, IMF, BIS, Business Today, New York Fed, StudyIQ

Advertisement

Advertisement