Image Source : Business Standard

Image Source : Business Standard

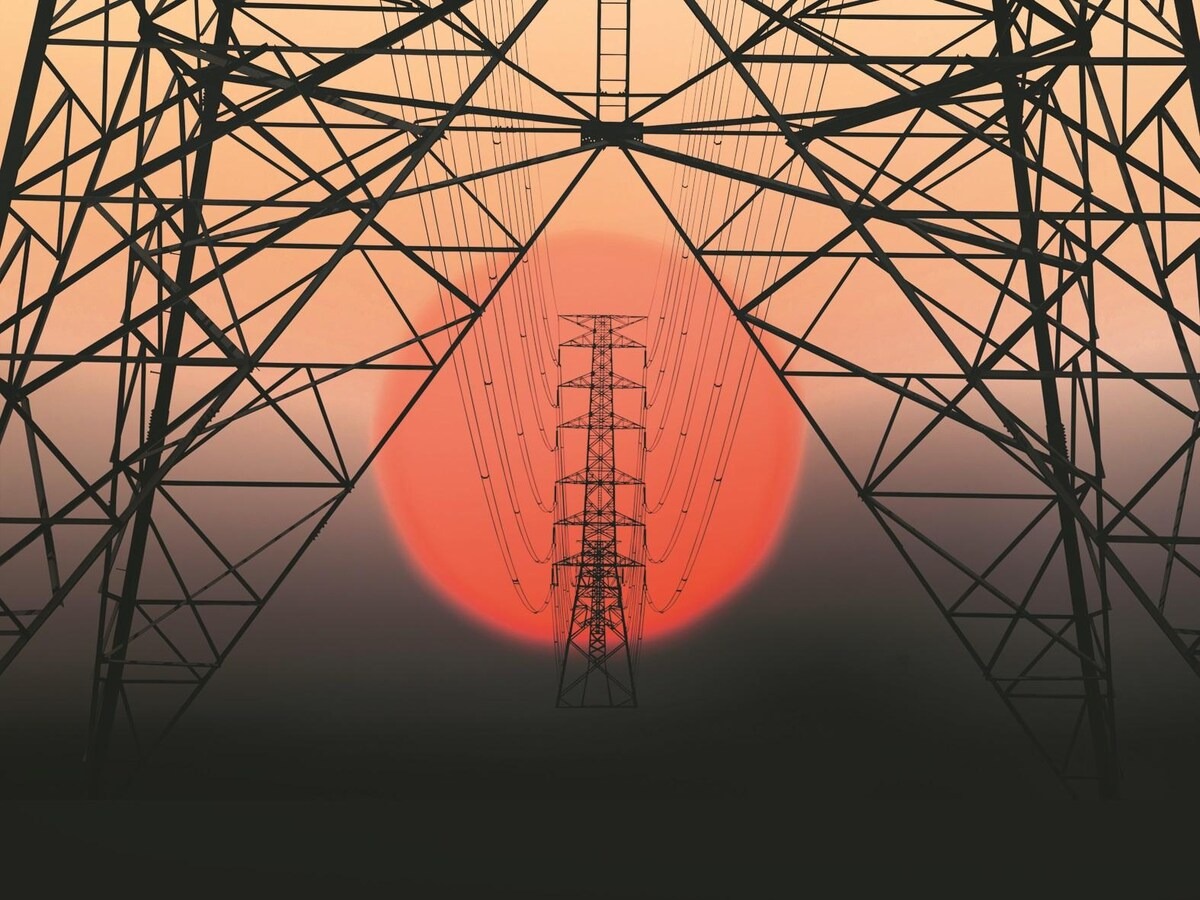

Power Grid Corporation of India has approved raising up to 38 billion rupees through non-convertible bonds. The move aims to strengthen its capital base, support infrastructure expansion, and ensure long-term financing for upcoming projects. The fundraising reflects the company’s strategy to maintain financial stability while meeting India’s growing power demands.

Show more

Power Grid Corporation of India Ltd. has announced board approval to raise funds of up to 38 billion rupees through non-convertible bonds. The initiative is part of the company’s broader plan to secure long-term financing for its extensive transmission network and upcoming infrastructure projects.

The fundraising will provide predictable returns to investors while enabling Power Grid to maintain liquidity and financial resilience. As India’s leading power transmission utility, the company continues to play a critical role in strengthening the national grid and supporting renewable energy integration.

Key highlights from the announcement include:

-

Approval granted to raise up to 38 billion rupees via non-convertible bonds

-

Funds will be directed toward infrastructure expansion and operational requirements

-

The move ensures stable financing while diversifying funding sources

-

Power Grid’s strategy aligns with India’s growing electricity demand and renewable energy goals

-

Non-convertible bonds offer fixed returns, enhancing investor confidence in the company’s debt instruments

This development underscores Power Grid’s proactive approach to capital management and its commitment to supporting India’s energy infrastructure growth.

Sources: Reuters, Economic Times, Business Standard

Stay Ahead – Explore Now!

Adroit Scores a Byte-Sized Fortune: ₹290M Order Secured

Advertisement

Advertisement