Image Source : Reddit

Image Source : Reddit

A viral LinkedIn post by investment banker Sarthak Ahuja has sparked a nationwide conversation about the financial fragility of India’s high-income earners. The post, which breaks down the monthly budget of a household earning Rs 70 lakh per annum, reveals how even top-tier salaries are no longer a guarantee of financial comfort in metro cities like Mumbai, Bengaluru, and Gurgaon.

The post has resonated with thousands of professionals, many of whom echoed similar experiences of living paycheck to paycheck despite earning what was once considered a dream salary.

Key Highlights From The Viral Breakdown

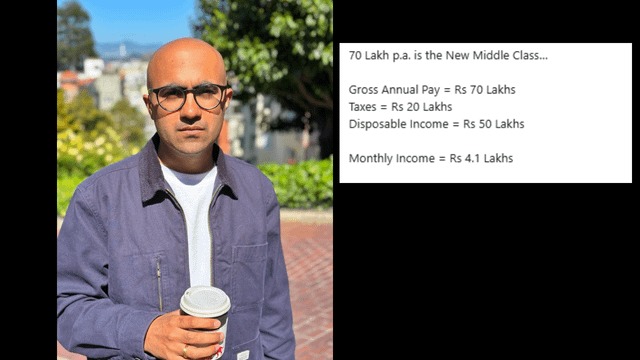

- A gross annual salary of Rs 70 lakh results in approximately Rs 20 lakh in taxes, leaving a net income of Rs 50 lakh or Rs 4.1 lakh per month

- Fixed monthly expenses include Rs 1.7 lakh for a home loan EMI, Rs 65,000 for a car loan, Rs 50,000 for international school fees, and Rs 15,000 for domestic help

- After these deductions, only Rs 1 lakh remains for all other expenses including groceries, utilities, healthcare, entertainment, and savings

- The post concludes that by the end of the month, there is virtually nothing left to save

What’s Fueling The Financial Squeeze

According to Ahuja and other financial experts, three major factors are driving this urban middle-class crunch:

- Rapid inflation in metro cities, especially in real estate, education, and essential services

- Housing prices that are 10 to 30 times the annual income, making home ownership a long-term financial burden

- Social media-driven aspirational lifestyles that push individuals to spend beyond their means

The Rise Of The Sub-Middle Class

Ahuja refers to this demographic as the new sub-middle class—individuals who appear affluent on paper but struggle to maintain financial stability. The post warns against rushing into big-ticket purchases like luxury homes and cars without a clear understanding of long-term affordability.

- Financial expert Saurabh Mukherjea adds that 5 to 10 percent of middle-class households are now trapped in debt

- India’s financial savings rate is at a 50-year low, while non-mortgage debt for discretionary spending is among the highest globally

- The ease of digital borrowing has made it simpler to accumulate debt, often without adequate financial planning

Public Reaction And Broader Implications

The post has triggered a wave of responses, with many professionals sharing similar stories of financial stress despite high incomes. Others have criticized the post for being tone-deaf or misleading, arguing that Rs 70 lakh still places one in the top income bracket nationally.

Nonetheless, the conversation has highlighted a growing disconnect between income and financial well-being in urban India. It also underscores the need for better financial literacy, realistic lifestyle choices, and a redefinition of what it means to be middle class in today’s economy.

Sources: Times of India, News18, Times Now, MSN India, India Today, Hindustan Times

Advertisement

Advertisement