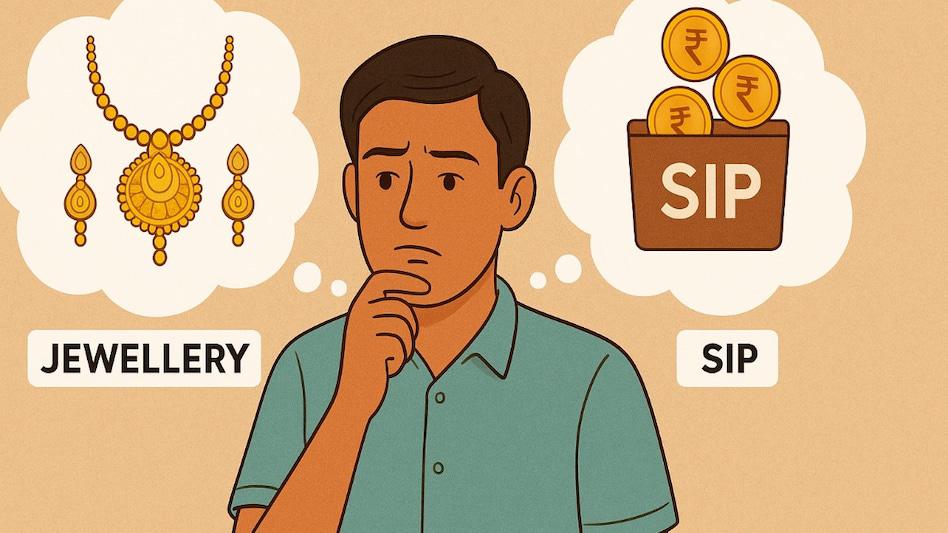

‘Gold Up 56%, Salary Down 0.07%’: Finfluencer Warns of Middle-Class Squeeze in India’s New Wealth Economy

India’s economic growth story is increasingly being told through the lens of asset appreciation—but not everyone is reaping the rewards. In a recent post that has gone viral, finance educator and influencer Akshat Shrivastava pointed out a stark contrast: gold prices have risen 56%, while average salaries have dipped by 0.07% over the same period.

Key Highlights from the Analysis:

Asset Boom vs. Wage Stagnation

The value of Indian household holdings in gold and equities jumped from $1.8 trillion to $2.7 trillion in just three years.

Meanwhile, salaried professionals—especially those without equity exposure—have seen real income stagnate or decline.

Middle Class Left Behind

Shrivastava emphasized that wealth creation is now asset-driven, leaving behind those who rely solely on salaries.

“People who invested in assets outpaced those depending on basic salary,” he noted.

Equity and ESOP Advantage

Employees in startups and tech firms with stock options (ESOPs) have seen significant gains.

In contrast, traditional salaried workers in sectors like manufacturing, education, and public service have missed out.

Inflation and Cost of Living

Rising prices in housing, education, and healthcare have further eroded purchasing power.

The middle class is increasingly squeezed between flat wages and soaring living costs.

Call for Financial Literacy

Shrivastava urged middle-income earners to diversify into assets like mutual funds, gold ETFs, and real estate.

He also stressed the importance of early investing and passive income streams.

Public Reaction

The post has sparked debate on social media, with many users echoing concerns about economic inequality and limited upward mobility.

This commentary underscores a critical shift in India’s economic fabric—where ownership of appreciating assets, not just employment, is becoming the key to financial security.

Sources: Business Today